Navigating the Texas small business landscape

This is a preview of our Texas 2036 newsletter celebrating the economic engine that is Texas’ small business. To receive this weekly look at our work, sign up here.

Small businesses in Texas: Job creators confront challenges, seize opportunities

Representing a dynamic segment of the Lone Star State’s economy, the state’s small businesses are engines of economic and employment growth while continuing to face operational and economic challenges.

We’re taking a look this week at this important economic sector and how our work can help support these entrepreneurs thrive in the long run.

Small Businesses: The MVPs of the Texas economy

Texas is home to millions of small businesses, each employing fewer than 500 employees. From tech startups in Austin to oil field services in Houston to the food truck down the street, small businesses are showcasing the diverse economic fabric of the state.

By the numbers:

3.1 million: the number of small businesses in Texas, making up 99.8% of all businesses in the state.

4.9 million: the number of employees working for Texas small businesses, making up 44.5% of all employees in the state.

In which industries would you find the most Texas small businesses? The construction industry (396,601 small businesses) and professional services (389,365 small businesses).

What challenges are we seeing?

Labor: Time and time again, small business owners cite the difficulty of finding workers as chief among the challenges they face in regaining their footing post-pandemic. In the face of this challenge, employers are becoming more creative in opening the doors to more segments of the workforce.

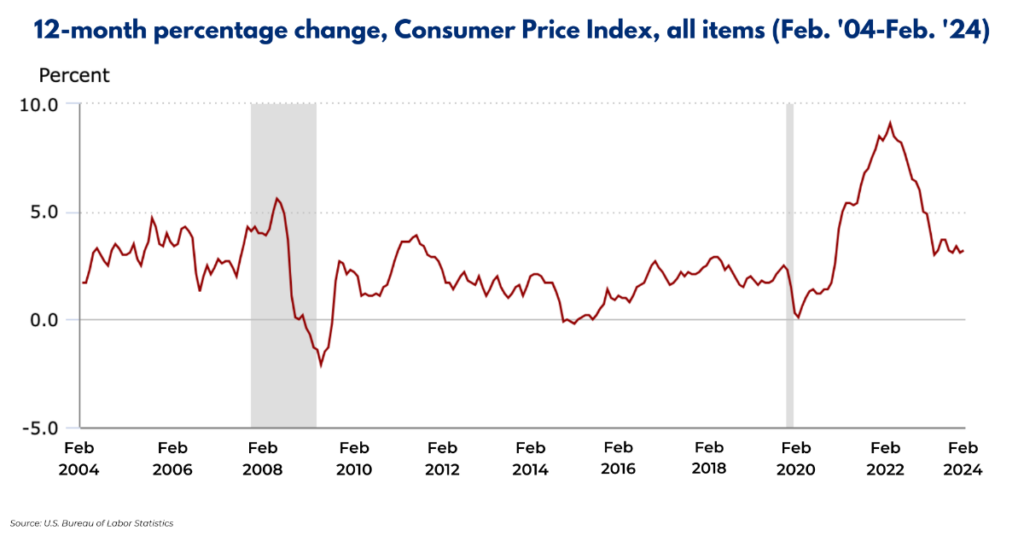

Inflation/rising costs: The rate of inflation has declined significantly over the last two years but remains persistently above the Federal Reserve’s target 2% rate. And while the rate of price increases might have slowed, it bears remembering that prices continue to increase.

It falls to small businesses, who already must manage thin profit margins, to make hard decisions about what goods and services they offer and what they charge customers.

Costs of borrowing: To combat inflation, the Fed used the biggest tool at its disposal, raising interest rates. The strategy has been successful in arresting rapid growth in inflation rates, but raising the cost to borrow money makes it more difficult to expand a business and it takes money out of consumers’ pockets that could otherwise be spent at a small business.

Changing customer habits: A more uncertain economic environment also means customers are changing their normal spending habits — cooking more at home instead of going to a neighborhood eatery, postponing a home improvement project or skipping a long-planned vacation. Those behavioral changes impact Texas small businesses’ bottom line.

🌈 The silver lining… Texas is a national leader in job growth. According to the Texas Workforce Commission, employment grew by 263,900 jobs from January 2023 to January 2024, which equates to a 1.9% annual growth rate.

Six issues we’re focused on:

1. Lack of skilled workers: Small businesses, like their bigger counterparts, are looking for skilled workers. According to NFIB State Director Jeff Burdett, 39% of small business owners said they had problems filling job openings, a challenge expected to continue through this year.

- What have we done to help? Texas 2036 supported legislative action last year to better align postsecondary credentials with developing those skills needed by small business owners.

2. Rising Cost of Health Care: Offering health insurance can be key in attracting well-qualified workers in a tight labor market. Over a third of small business employers told eHealth this month that they could not cover health benefits because prices were out of reach.

- What have we done to help? Texas 2036 has supported efforts to make health coverage more affordable and accessible through the ACA exchange, opening an alternative to the traditional employer-supplied health insurance model.

3. Access to Child Care: Texas’ economy loses over $9 billion every year due to inadequate child care, according to Employers for Childcare. And among Millennials and Gen Zers, 75% of women and 68% of men say that the lack of access to affordable child care is a barrier to their professional success.

- What have we done to help? Texas 2036 is a proud member of Employers for Health Care, which will work toward legislative solutions next year to better address the challenge of offering quality, affordable child care.

4. Access to Water, Energy and Broadband: Basic infrastructure is as important to a business owner as it is to any other Texan.

- What have we done to help? Texas 2036 supported efforts last year to make meaningful investments in expanding the state’s water supply and access to broadband internet. We are currently rolling out tools to help better plan our state’s energy future.

5. Access to Affordable Housing: A stable supply of affordable housing is similarly important to supporting a stable pool of workers from which small businesses can draw.

- What have we done to help? Texas 2036 supported legislative efforts to make it easier to review, approve or deny development documents, plans and permits responsive to Texas’ need for more housing options.

6. Impacts of Extreme Weather Events: An increase in extreme weather events is making insurance more expensive and harder to obtain. This impacts small business owners as much as it affects residential homeowners in Texas.

- What have we done to help? Texas 2036 is rolling out new data on the increase in extreme weather events, which should allow for smarter planning on how to grow the state in the coming decades.

A call to action for the Texan spirit

The spirit of Texas is in its small businesses – resilient, dynamic and ever-evolving. We all must work together to nurture this ecosystem to ensure Texas is the best place to live and work.

By fostering a supportive environment for small businesses to thrive, we can ensure that the heart of Texas’ economy continues to beat strong.

What should be done to support small business owners and entrepreneurs in Texas?

Let us know in our short survey!