What to expect in 2026 ACA Marketplace: A changing landscape

The Affordable Care Act (ACA) Marketplace remains a vital source of affordable health coverage for millions of Texans, especially in a state that continues to lead the nation in uninsured residents. As we approach the 2026 plan year, premiums are expected to rise, but most Texans will still find low-priced (and even free) coverage options that keep care within reach.

Affordable Coverage Still the Norm

For most Texans, the ACA Marketplace will continue to offer affordable, and often $0–premium, plans. In 2025, about 75%, roughly 3.1 million Texans, had incomes below 200% of the Federal Poverty Level (FPL), or about $30,000 for an individual and $60,000 for a family of four. Everyone in this income range will again have access to at least one $0–premium plan in 2026.

While most current enrollees will continue to benefit from affordable coverage, a number of uninsured Texans could also qualify for similar $0-premium plans. Using 2024 American Community Survey (ACS) data, about 5.1 million Texans remain uninsured and about 1.4 million Texans fall within 100-200% FPL. While available data does not allow for exact precision, our latest modeling, built on our “Who are the Uninsured?” findings and updated ACS data, suggest that roughly over a million uninsured Texans could qualify for a $0-premium Marketplace plan. This finding highlights the level of access that remains available through the Marketplace for both current enrollees and the uninsured.

All Marketplace plans in Texas also include free preventative care, along with low or no out-of-pocket access to primary care, generic prescriptions, mental health services, and telehealth, even for plans with higher deductibles. These benefits help ensure that routine care remains accessible to families across the state.

Premiums Are Rising, But Most Texans Are Protected

Premium increases are expected in 2026, particularly for higher-income enrollees, as temporary COVID-era federal subsidies expire. While these increases may draw headlines, the overwhelming majority of current Texas enrollees will still have access to free or inexpensive plans. Federal premium tax credits under the ACA will continue to offset monthly premiums for the majority of enrollees, keeping coverage affordable or even free for many households.

Texas also remains better positioned than most states to maintain affordable options. The state’s 2021 premium alignment law, Senate Bill 1296, ensures that Texans benefit more from subsidies than in many other states, making bronze and gold plans especially more affordable than in states that have not adopted such a regulation.

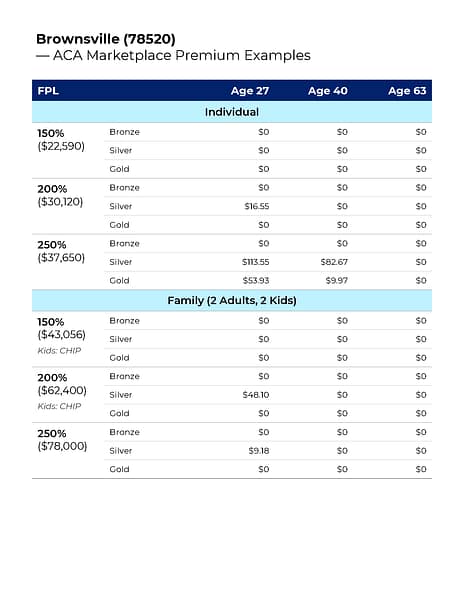

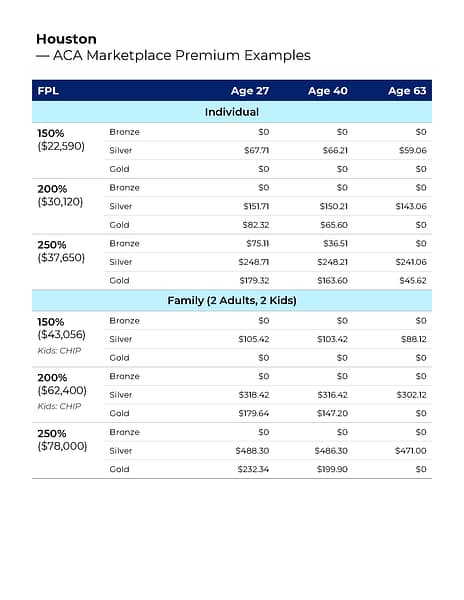

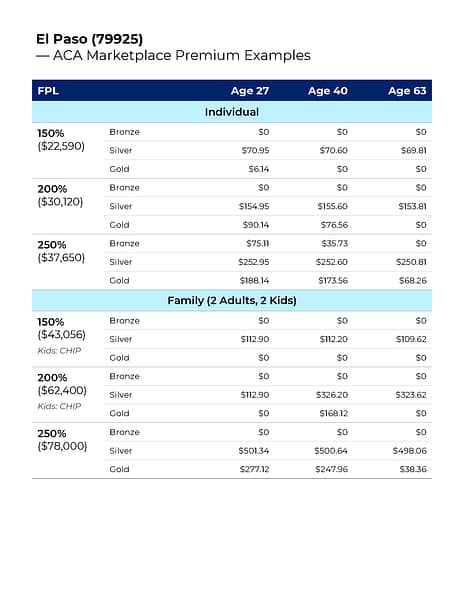

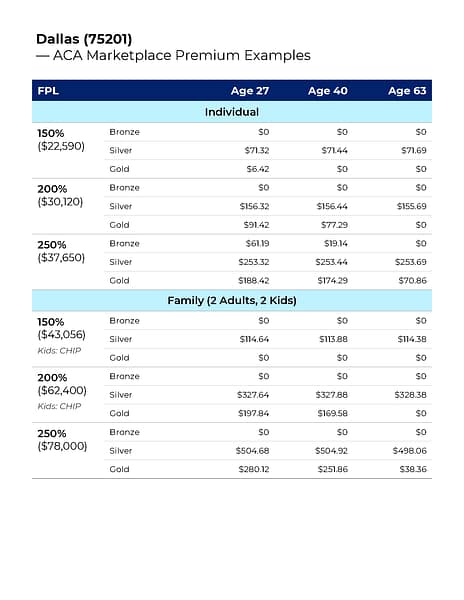

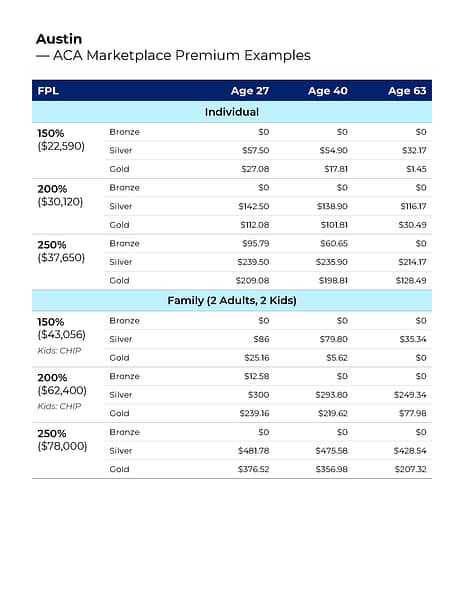

As premiums change, affordability depends heavily on where Texans live and their income levels. Across the state, from Houston to El Paso, free or low-premium plans will still be widely available. The tables below highlight how premiums for a variety of household scenarios compare in several regions.

Texans earning below 200% FPL can still find at least one $0–premium plan. Even those earning up to 250% FPL often pay less than $100 a month for comprehensive Gold-tier coverage — showing that affordability remains within reach for many Texas families.

How Enrollment Will Change

We expect enrollment to dip slightly in 2026 as premiums rise, enhanced federal subsidies expire, and fraud-reduction efforts strengthen. However, we anticipated Texas’ enrollment decline to be smaller than national forecasts, reflecting the state’s competitive marketplace and continued access to $0–premium plans for most lower-income enrollees.

Some of the drop will stem from stricter oversight of fraudulent or “ghost enrollments,” which are fake or duplicate accounts created to inflate sign-ups. We anticipate that the stricter documentation and administrative requirements designed to reduce fraud will also have downward pressure on non-fraudulent enrollment, due to the increased administrative burden of enrolling.

Plan choices are also shifting. We expect that Texans focused on finding $0 plans will shift enrollment away from Silver-tier plans (fewer of which will be available at $0 premium) and toward Bronze and Gold options. For lower-income families, who will still qualify for free coverage, enrollment should remain strong. Potential enrollees with incomes below 250% of the FPL should weigh the trade-offs between a higher monthly premium for silver-tier coverage, and the lower out-of-pocket expenses for care they may be eligible for if they enroll in a silver-tier plan.

Headlines about higher premiums, without mention of eligibility for free or low-cost plans, reinforce many Texans’ belief that health insurance is unaffordable, even when that is not the case. Our “Who are the Uninsured?” report found that for many Texans, the belief that they cannot afford coverage remains one of the biggest barriers to enrollment. Continued outreach and education will be key to helping families understand their choices and stay covered.

Looking Ahead

The 2026 ACA Marketplace will bring higher sticker prices but continued affordability for most Texans. Enrollment may soften slightly as subsidies roll back and fraud enforcement tightens, yet the overall system remains strong.

Sustained outreach and clear communication will remain essential to helping Texans understand their options, keeping families insured and healthy, no matter what changes the next plan year brings.