Tax exemptions’ effect on Texas revenue: Strategic Framework

This is part of our blog series for Texas 2036’s Strategic Framework, which provides in-depth, cross-cutting data to inform key decisions about the most significant issues facing the state.

Since July 2022 when the Texas Comptroller announced a large uptick in state revenue for the current biennium, folks watching the Texas budget have wondered and speculated how the 88th Texas Legislature may choose to deal with the fund balance. This projected record $27 billion general revenue fund balance is driven mostly by record sales tax collections.

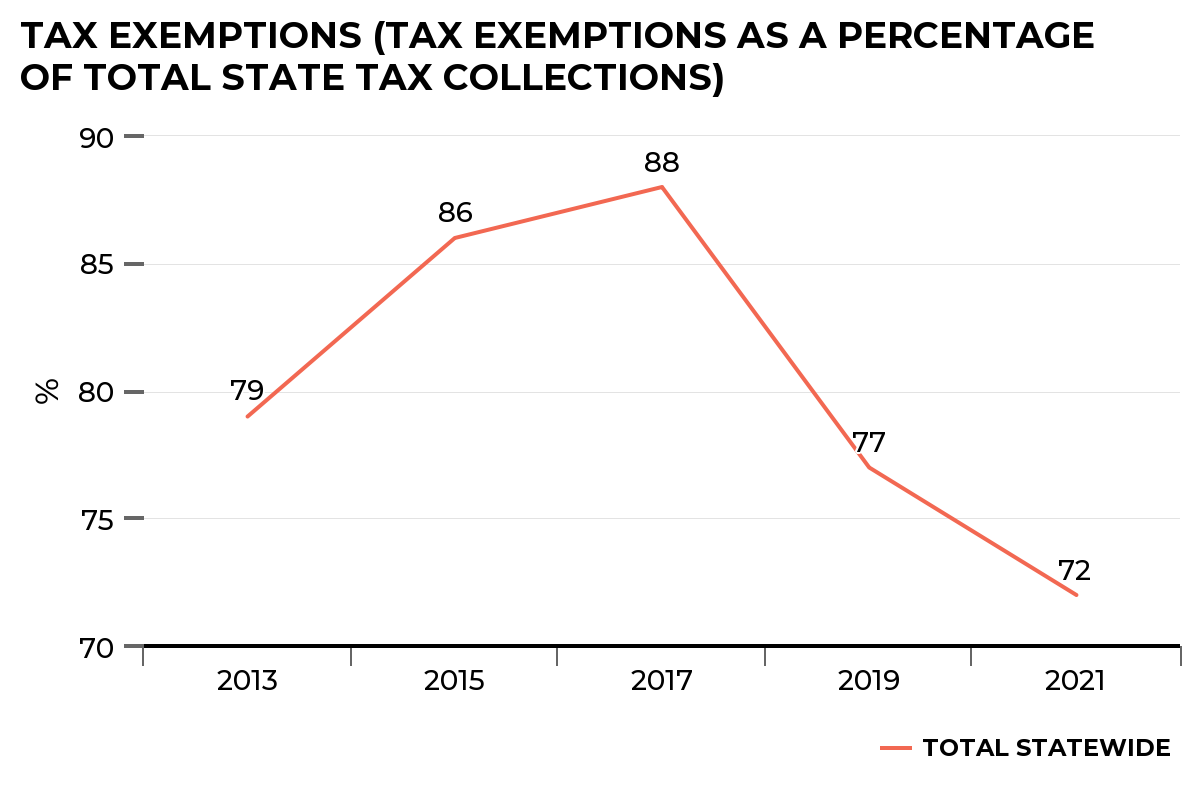

What many Texans may be interested to learn is the degree to which tax exemptions, exclusions and discounts available in Texas have on our state tax revenue base. Texas’ tax base is the total amount of transactions, property, assets, consumption, transactions or other economic activity subject to taxation by the state. As part of our Strategic Framework, Goal No. 29 uses data from the Comptroller’s office to show this reduction of our state tax base from these exemptions—think sales of materials used in manufacturing — relative to total state tax collections.

For example, in FY21, state tax exemptions, used here as a generalized category including exemptions, exclusions and discounts, added up to an estimated $44.5 billion dollars versus $61.5 billion in total state tax collections, resulting in the 72% ratio of state tax exemptions to total state tax collections. What is even more interesting is that while our total sales tax collections, the largest source of state tax revenue for Texas, was $36 billion of those total state tax collections for FY21, its corresponding estimated sales tax exemptions totaled $42 billion of the total $44.5 billion in exemptions.

Taken in a vacuum, it is easy to look at those numbers alone and think this is another example of Texas’ tax-friendly environment for people and business. Especially considering that in 2019, the gross sales of businesses required to file sales tax reports was over $2.5 trillion, while the amount subject to sales tax was $557 billion, or less than a quarter of those reported sales.

However, instead of just accepting these numbers as an example of Texas’ leadership on having a competitive tax environment, other analyses on our Strategic Framework dashboard on individual and business tax burden as well as tax incidence can provide additional context. For the future, Texas 2036 is interested in analyzing how Texas may compare to its other peer states with regard to this measure on tax exemptions relative to tax revenue. Interested in learning more? Let us know!