The death of the starter home?

First-time homebuyers are facing big obstacles in their hunt for a starter home. Housing prices in Texas have risen over 30% since the beginning of the pandemic. And even though wages are rising, they aren’t keeping up with this meteoric increase in prices.

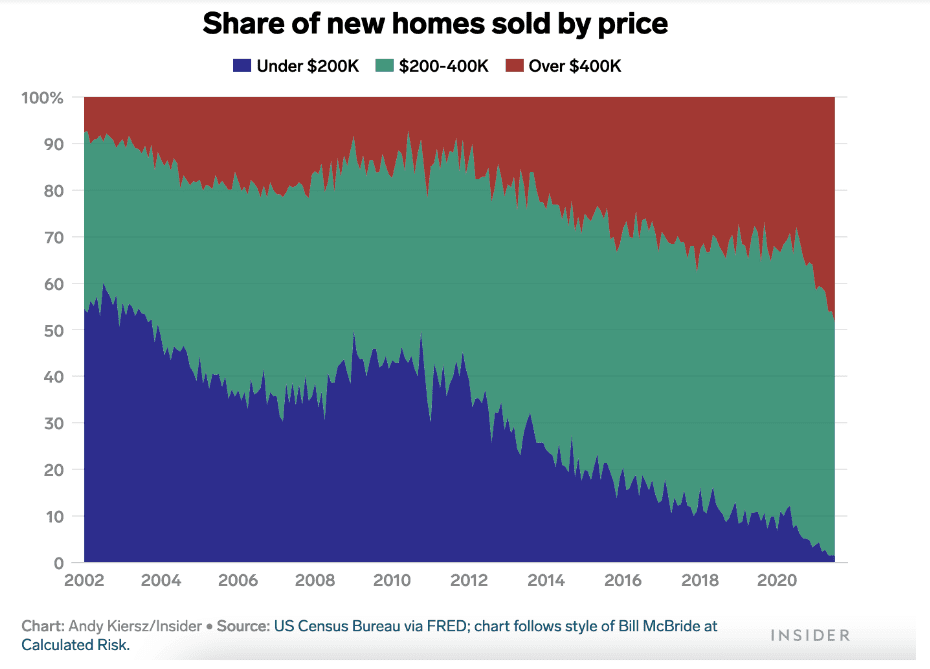

While there’s no true definition of a “starter home”,” the chart below illustrates the disappearance of homes for sale at lower price points. In 2022, only 66,000 homes (or 10.2%) were sold for less than $300,000 nationwide, which is down from 292,000 (or 42.7%) in 2019.

Several causes for housing price increases

Several causes for housing price increases

So what’s behind this steep run-up in housing prices that has put Texas and the rest of the country in a housing affordability crisis?

- COVID-spurred societal and economic realignments: Flight from cities, the creation of 1.6 million new households a year, low interest rates leading to high demand, a glut of savings and supply chain disruptions have fueled an upward spiral of increases in home prices.

- Rapid population growth: Texas has added 4.9 million new residents in the past 12 years. That includes 470,708 new Texans between July 2021 and July 2022 alone.

- Underproduction: The U.S. built fewer homes in the decade after the financial crisis than in any other decade since the 1960s.

- Overregulation: Builders estimate that the cost of compliance with local state and federal regulations can make up nearly 24% of a home’s final cost.

- Land use restrictions: With the advent of modern zoning in the 1920s, American cities began to adopt the quintessential American building patterns. That means large lots with single family homes segregated from commercial centers and dependent on cars. This restricts the availability of buildable land.

Housing affordability a concern for Texans

These factors add up to a startling conclusion: it is a lot harder for young families to get on the property ownership ladder.

Texans are in a near consensus about the gravity of rising home prices. A recent Texas 2036 voter poll revealed that 91% of registered voters have some level of concern about housing affordability. Another 88% are concerned about recent increases in housing costs.

Already, the 88th Legislature has shown creativity in tackling housing affordability from a statewide perspective. Lawmakers have already filed several bills that seek to ease the way to creating more diverse housing options for the 30 million Texans that are here, and the eight million more that will move to our state by 2036. In a series of blogs over the next few weeks, we’ll look into those proposed statewide changes and how they have the potential to increase home ownership opportunities for working and middle class Texans.