Rising health care prices put teachers and lawmakers in a tough situation

As we approach the halfway point in the legislative session, teachers have been at the center of many of the most important legislative debates. Headlines across Texas have highlighted the challenges many school districts have faced in hiring and retaining teachers. Lawmakers have zeroed in on proposals to increase teacher pay and improve teacher quality of life.

It may seem strange that at the exact same time, active teachers are facing potential cost increases for health insurance – potentially eating away at the same salaries legislators are seeking to increase. Teacher benefits are an inseparable part of any conversation about teacher pay. As highlighted in the recent Teacher Vacancy Task Force Report:

Recognizing that factors such as health care premiums, childcare and housing all impact teacher take-home pay, the Teacher Vacancy Task Force also recommends improved benefits in addition to salary increases.

Texas 2036 has warned of the risk of cost increases in the past, and lawmakers have been able to achieve some stopgap solutions to slow the arrival of this challenge. Texas 2036 believes there are long-term solutions that can help address the underlying trends, but there are also urgent decisions that must be made in the short-term, with just 79 days remaining in session. In upcoming weeks, budget writers will likely need to decide on one of those major questions: Who will bear the cost of rising health care prices: teachers, schools or taxpayers?

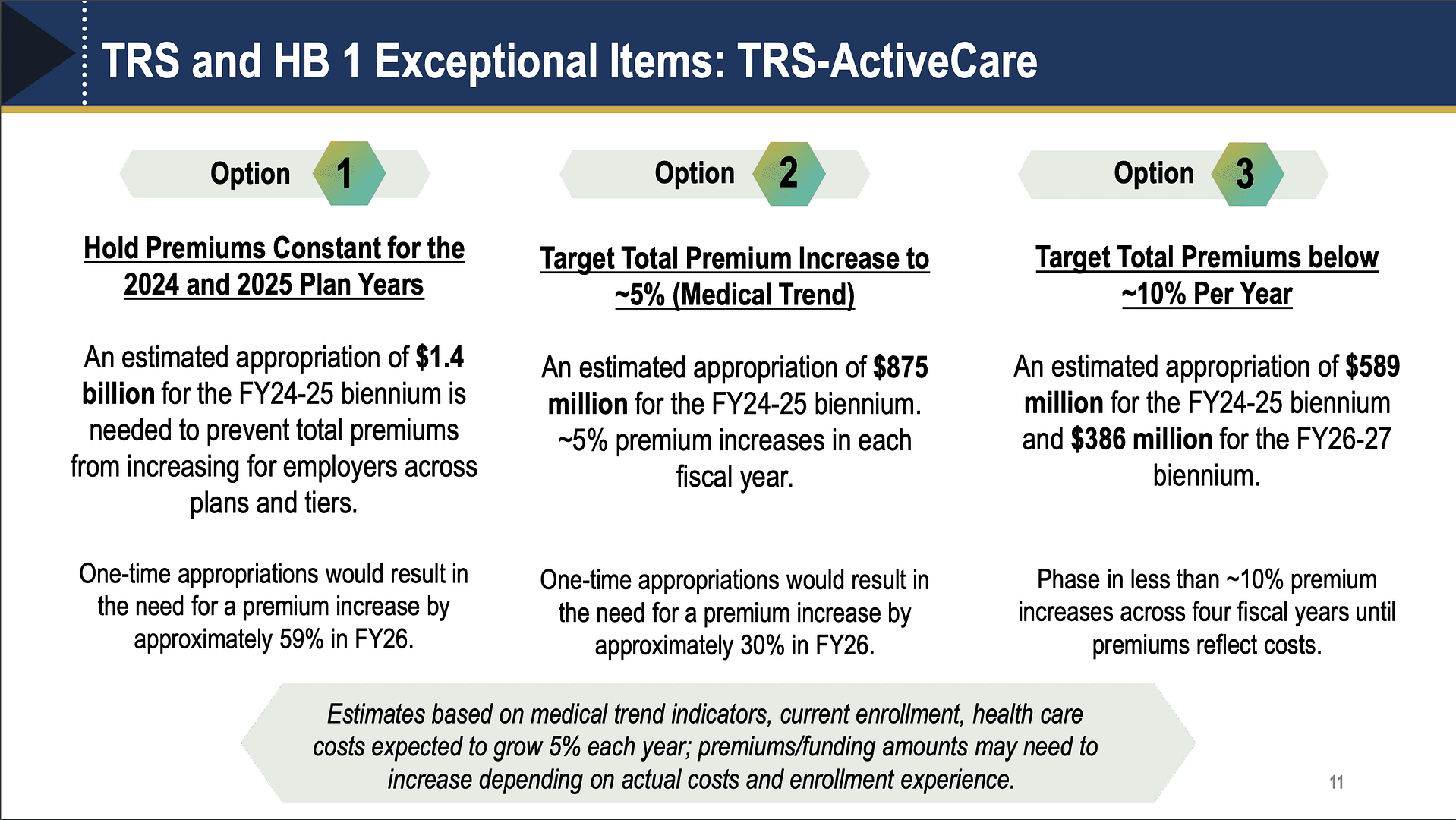

Texas appropriators are currently considering three proposals to address a budgetary issue relating to health insurance for teachers offered through the Teachers’ Retirement System, or TRS. The issue facing appropriators and TRS is an estimated $1.4 billion shortfall between currently anticipated revenues and currently anticipated expenses for their health benefit plan going forward. The House Appropriations Article III Subcommittee heard these proposals on Feb. 27. An initial decision could come in the next few weeks, as House Appropriations and Senate Finance conclude their committee bill drafts.

These proposals impact the health insurance provided by TRS-ActiveCare, which offers benefits to approximately 444,000 active teachers and family members.

Source: Texas House of Representatives Appropriations Subcommittee on Article III meeting notes from Feb. 27, 2023.

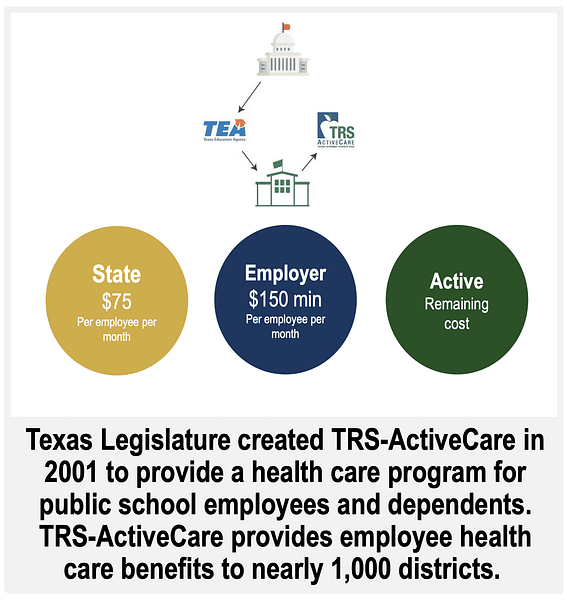

The three proposals provide different options for splitting the $1.4 billion shortfall between the state, school districts and teachers. Much attention has been paid to how to split this bill because of the way that the TRS health benefit plan is funded. While TRS develops and administers the plan, TRS is not the employer of teachers – rather, the employer is the local school district. As the primary employer, the local district is responsible for contributing a minimum of $150 per employee per month toward the health benefit plan. The state’s contribution is fixed at $75 per employee per month and the teacher bears the remaining cost out of pocket. When this law was passed in 2001, $225 covered the total monthly for an individual employee.

Source: Texas House of Representatives Appropriations Subcommittee on Article III meeting notes from Feb. 27, 2023.

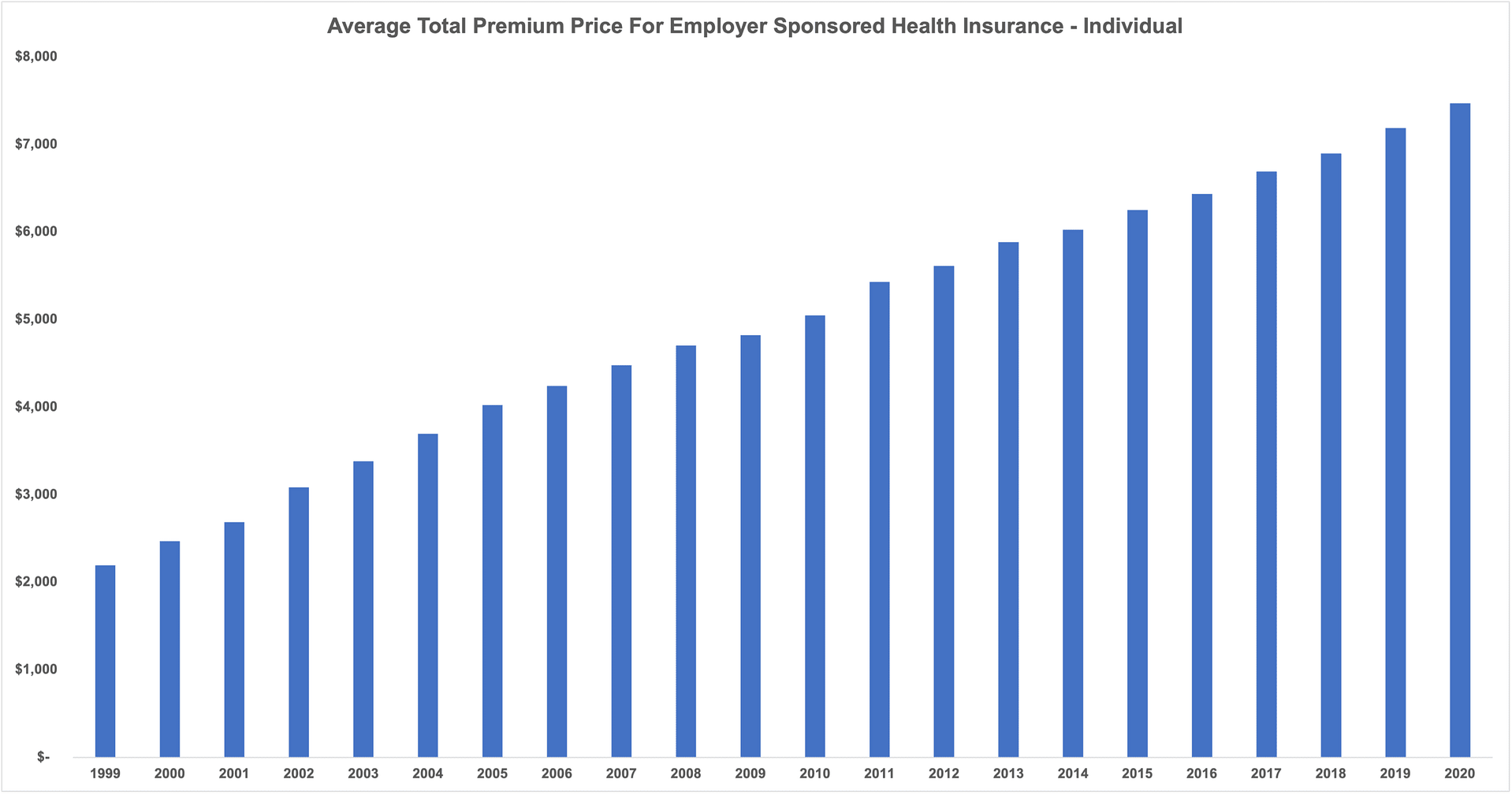

Over the last couple of decades, though, health spending on employer sponsored insurance has increased dramatically. According to the Kaiser Family Foundation’s Employer Health Benefits survey, the average premium for individual employer coverage has nearly tripled – increasing from $2,689 annually, or $224 per month, in 2001 to $7,470 annually, or $622 per month, in 2020.

Source: KFF Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2020

While discussions around how to divide the cost of premiums between the state, the local district and the teacher will be relevant and there may be a place for updating the current contribution formula, perhaps the more important question is how to reduce the total cost. Without addressing the root cause of the cost increases, the legislature risks buying a very expensive Band-Aid.

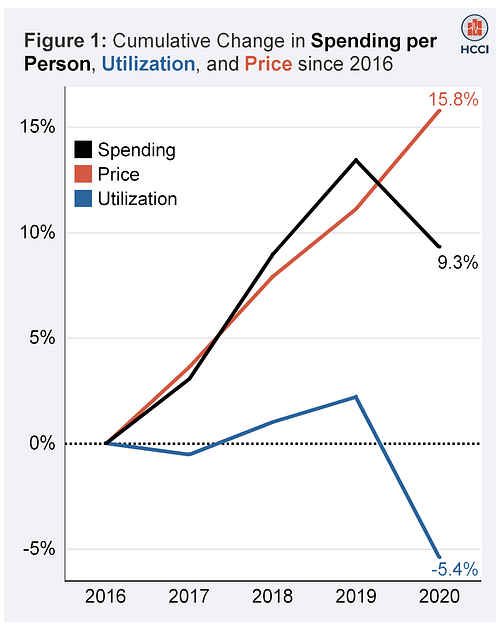

The problem faced here by TRS is not unique to TRS, but is rather the exact same problem facing employers all over the state. At Texas 2036, we know research shows that nationally, the largest driver of increased health expenditures for employer sponsored health benefit plans is higher prices, rather than increases in utilization from changing demographics.

Source: Health Care Cost Institute 2020 Health Care Cost and Utilization Report

Because of recent price transparency laws that went into effect, for the first time it has become possible to assess the prices negotiated by our state employee benefit plans against other large employers in the state. Texas 2036 partnered with Mathematica to do such a study and are in the midst of such an evaluation. While we don’t have final results available for publication at this time, our early indications are that the prices negotiated by TRS are as good or better than other large employers in the state. That is, TRS appears to be performing in line with the private sector when negotiating prices. But simply doing as well as private sector companies is little comfort when everyone is facing the market consequences of higher prices.

Why do prices continue to rise unabated, and what can we do about it?

The economic literature is clear that prices continue to rise due to market concentration and market power. These problems represent an unhealthy market for health care, and in order to empower TRS to address the overall cost issue, Texas needs to address the broader problem of unhealthy markets in the state. In order to do so, legislators should consider options that would promote healthy markets – which means markets that are informed, competitive and engaged.

- An informed market requires transparency of both price and quality information about health care services. Solutions here would build upon and expand existing transparency rules.

- A competitive market is one in which multiple options are available, prevents further consolidation and concentration, and promotes new market entrants.

- An engaged market is one in which patients and providers both have the appropriate incentives. For patients, this means incentives to seek out high-value care, and for medical providers, this means incentives to deliver high quality care at a competitive price, and to refer their patients to other providers who offer that.

In the coming weeks, lawmakers will be forced to make some difficult decisions on how to apportion the burden of rising prices. But lawmakers also have an opportunity to address the root causes of these issues in a way that can help empower all Texas employers – including our schools – to offer health benefits to employees that are both high quality and affordable. Healthy teachers need healthy markets.