Housing affordability in Texas: Strategic Framework

This is part of our blog series for Texas 2036’s Strategic Framework, which provides in-depth, cross-cutting data to inform key decisions about the most significant issues facing the state.

Texas has long prided itself on the affordability of its housing, but as prices rise rapidly in comparison to income, homeownership may soon be out of reach for many Texas families.

To ensure that Texans will have the opportunity to achieve a middle-class life, we look to data about housing affordability in Goal No. 36 of our Strategic Framework.

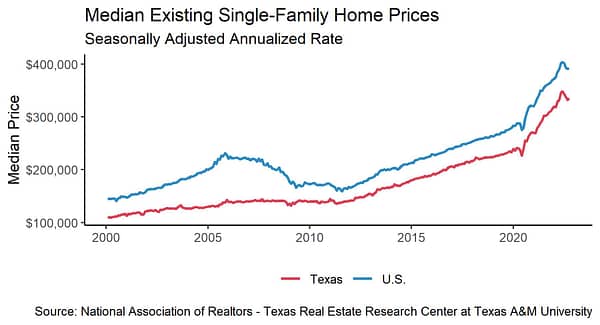

One data point used to measure housing affordability is the ratio of home price to income. Generally a ratio of 3.0 or lower is considered affordable. For decades, median home prices in Texas were less than three times median income, but, as of 2018, that is no longer the case—nor are these rapid price increases confined to one part of the state.

One data point used to measure housing affordability is the ratio of home price to income. Generally a ratio of 3.0 or lower is considered affordable. For decades, median home prices in Texas were less than three times median income, but, as of 2018, that is no longer the case—nor are these rapid price increases confined to one part of the state.

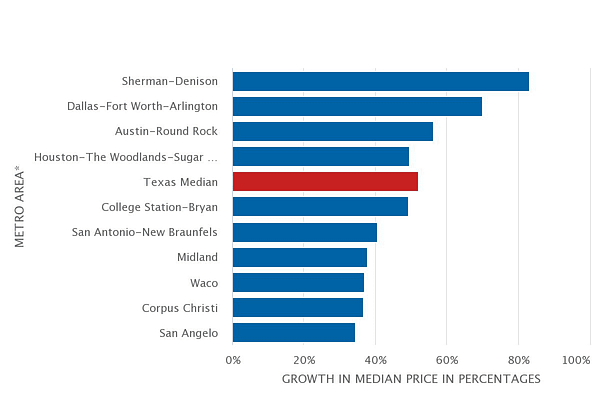

This chart from the Texas Comptroller — which reflects pre-pandemic housing cost growth — shows some of the fastest growth in Texas cities from 2011 to 2017 and represents a diverse set of geographies and populations.

The COVID 19 pandemic exacerbated this disconcerting trend. The chart above shows skyrocketing home prices from 2020 to 2022. Even as the market cools in light of increasing interest rates, median home prices are still 35% higher than they were in March of 2020.

Texans should be alarmed.

Homeownership is among the most common ways that Americans can accrue wealth and move themselves into the middle class. According to the Federal Reserve in 2019, the net worth of the median home owner was $255,000, nearly 40 times that of the median renter, whose net worth stood at $6,300. In fact, Americans have 61% of their assets in their primary residence.

Nationwide, homeownership rates are still recovering from historic lows in 2016. If the prospect of owning a home becomes an unattainable luxury, the ramifications for working and middle class Americans could be severe. Homeownership is a critical component of healthy financial futures and strong communities.

Nationwide, homeownership rates are still recovering from historic lows in 2016. If the prospect of owning a home becomes an unattainable luxury, the ramifications for working and middle class Americans could be severe. Homeownership is a critical component of healthy financial futures and strong communities.

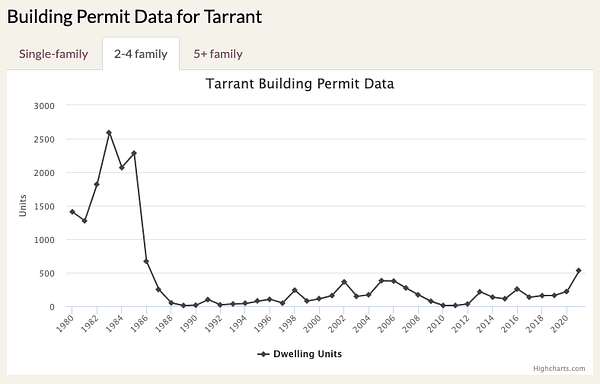

In the pursuit of solutions to our housing affordability crisis, Texas municipalities should consider increasing density by stepping away from a focus on single family residential zoning and easing the way for the construction of small multi-family units like duplexes and townhomes.

Consider the city of Fort Worth, one of the cities with the fastest housing price increases in the state. In the city’s Comprehensive Land Use Plan, it notes that while 48% of respondents to a National Association of Realtors Community Preference Survey indicate they desire to live in urban and walkable mixed use neighborhoods, more than 90% of Fort Worth residents live in automobile oriented neighborhoods. Unfortunately, in part due to land use restrictions—45% of land in Fort Worth is zoned for single family residences only—the market is unable to respond to those preferences.

This chart shows a striking image of how those small multi family options, often referred to as “missing middle” housing, are in fact missing from the array of options available to aspiring homeowners. By reconsidering our focus on single family zoning, Texas can add rungs to the homeownership ladder for working and middle class Texans.

This chart shows a striking image of how those small multi family options, often referred to as “missing middle” housing, are in fact missing from the array of options available to aspiring homeowners. By reconsidering our focus on single family zoning, Texas can add rungs to the homeownership ladder for working and middle class Texans.