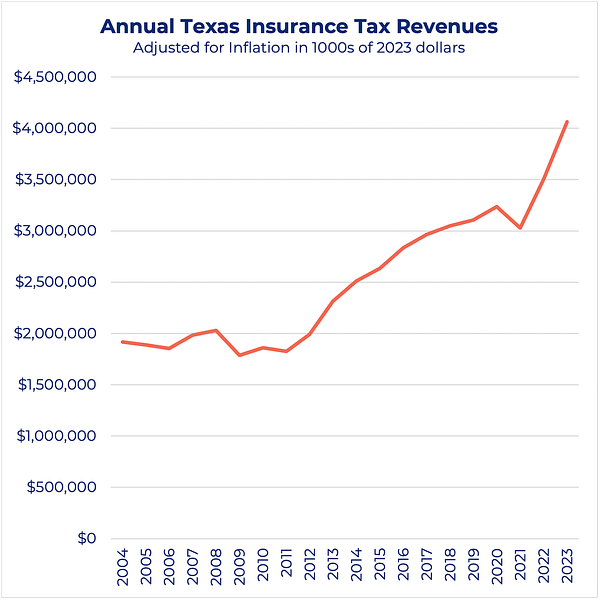

Insurance taxes: An unexpected driver behind increased revenues

Texas Comptroller Glenn Hegar last month told a Texas Tribune Festival audience that he expected to revise the Certification Revenue Estimate upward. It is certainly noteworthy that the CRE, an update of the state’s revenue outlook for the current fiscal year 2024-25 biennium, has turned out higher than expected given that Hegar had previously forecasted a recession.

But the Comptroller suggested at the Tribune event that this unexpected increase was driven by insurance premium tax collections, rather than sales tax or severance tax collections, that were well above expectations in the 2023 fiscal year. He cited specifically the impact of extreme weather events on property insurance rates.

The new CRE arrives days before the start of the next special legislative session, which will begin Oct. 9 and will address several issues, most notably education. During the regular session, on top of $6.3 billion in new public education spending, an additional $4.5 billion was approved by the Legislature contingent on passage of school finance and school choice legislation.

Given the anticipated size of the surplus at the end of the next biennium, this improved revenue outlook provides more opportunity for legislators to find solutions and compromise. However, policymakers must be wary of the trend underlying this upward revenue trend.

Extreme weather batters insurers

Press stories illustrating this trend of significant increases in home insurance premiums driven by increased frequency of extreme weather have tended to focus on states like Florida and Louisiana. Some insurers in those two states have even left the market after suffering billions in hurricane-related losses. In California, meanwhile, the Wall Street Journal reported earlier this year about how a few larger insurers have stopped writing new home policies due to wildlife risk.

Source: Texas Comptroller of Public Accounts; Bureau of Labor Statistics CPI data for All Urban Consumers (CPI-U)

Texas, with its own unique exposure to multiple categories of extreme weather, is unsurprisingly experiencing a similar trend of recording home insurance rate increases that are among the highest in the country. In the second quarter of 2023 alone, Texas approved 39 homeowner insurance rate increases, with 21 rate hikes over 10%.

An S&P Global analysis found, in terms of total calculated premium increase, six of the nine largest rate hikes in the country were in Texas, including the largest one of the quarter: a 24.1% rate increase worth $337.1 million in increased calculated premiums projected to affect over 650,000 policyholders.

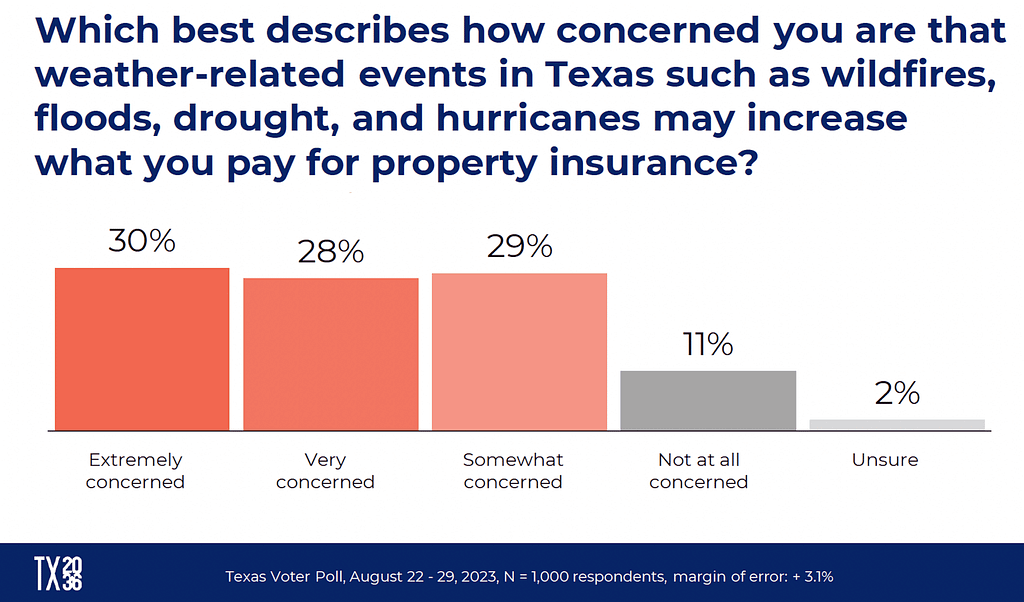

Texans are concerned, too

Texas 2036’s recent polling reflects anxiety among Texas voters on the issue. In an August survey of 1,000 registered voters, 87% of those surveyed expressed concern about the impact of extreme weather on insurance premiums, with 58% saying they were extremely or very concerned.

The overall trend of Texas voters concerned about extreme weather’s impact on property insurance costs held generally across age, race, gender, population density, and partisan lean, with a slightly lower, but still high 68% of West Texas voters reporting concern.

As extreme weather events in Texas increase in frequency and intensity, costs for insurers and reinsurers will only get higher relative to coverage, passing costs to insurance customers. An unabated trend of higher costs and less value not only exposes property owners to greater risk, but can eventually result in insurers pulling out of the Texas market.

Insurers withdrawing from Texas would have consequences ranging from the loss of billions in state revenue to the economic ripple effects caused from property owners not having the safety net of insurance to assist in recovery after an extreme weather event. How Texas will mitigate and reduce the likelihood of these scenarios is dependent on the actions taken to make the state resilient to extreme weather.

Read more:

- Budget conference report is out: Some initial takes

- A historic revenue outlook: 5 quick takeaways

- Comptroller to release revenue estimate next week

Love this blog? Support our work.