Why rising prices of health insurance matter for Texas employers

Recent findings from the KFF 2025 Employer Health Benefits Survey show that the increasing price of health insurance is putting a strain on employers and employees. Premiums have climbed steadily, eroding gains from wage growth and threatening the affordability of employer-sponsored coverage.

Increasing Prices, Shrinking Paychecks

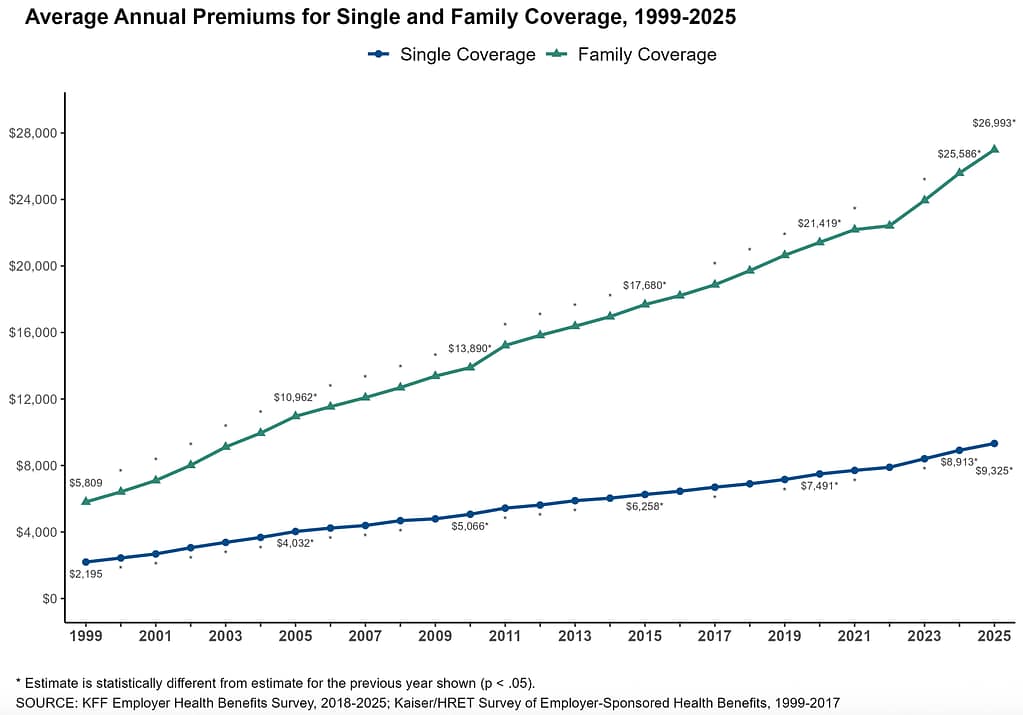

Nationally, the average annual employer-sponsored health insurance premiums in 2025 are $9,325 for single coverage and $26,993 for family coverage, an increase of 5% and 6% respectively from 2024. The average annual premium for family coverage is roughly one-third of Texas’ median household income. Since 2020, family premiums have increased 26%, and since 2016, they are up 53%.

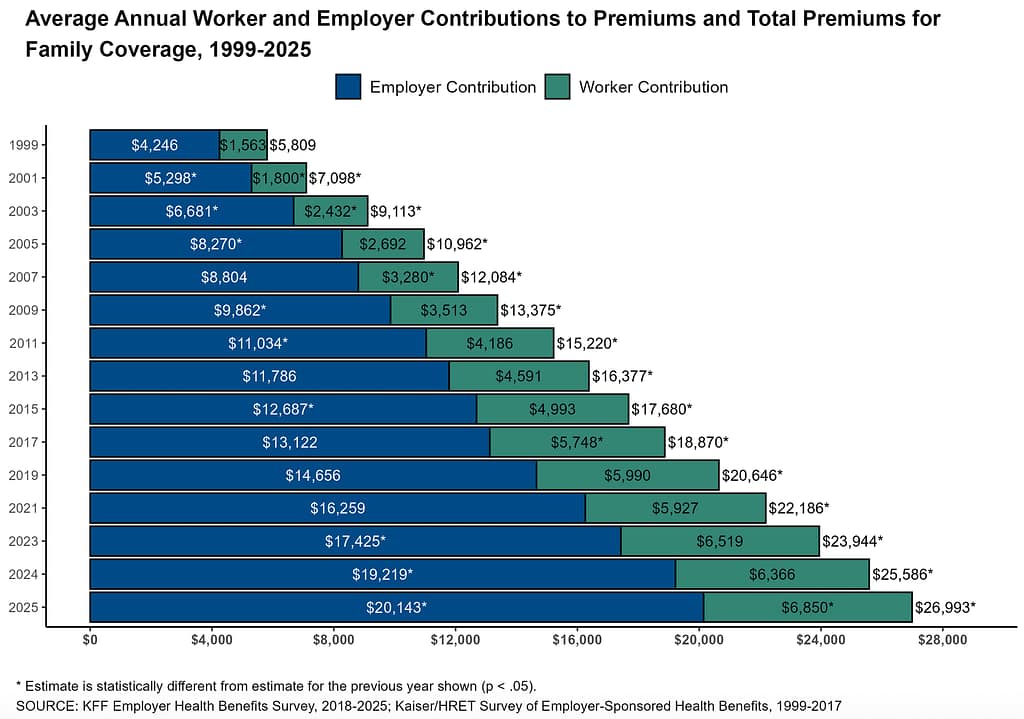

The vast majority of workers contribute toward their coverage. Average contributions for single coverage remained steady at $120 per month ($1,440 annually), while average contributions for family coverage increased to $571 per month ($6,850 annually), up from $6,366 last year. Over the past decade, the average worker contribution toward family coverage has increased 37%, in conjunction with significant employer contribution increases as well. While employers and employees may have different direct contribution amounts toward insurance, all contributions — employer and employee alike — come out of employee compensation.

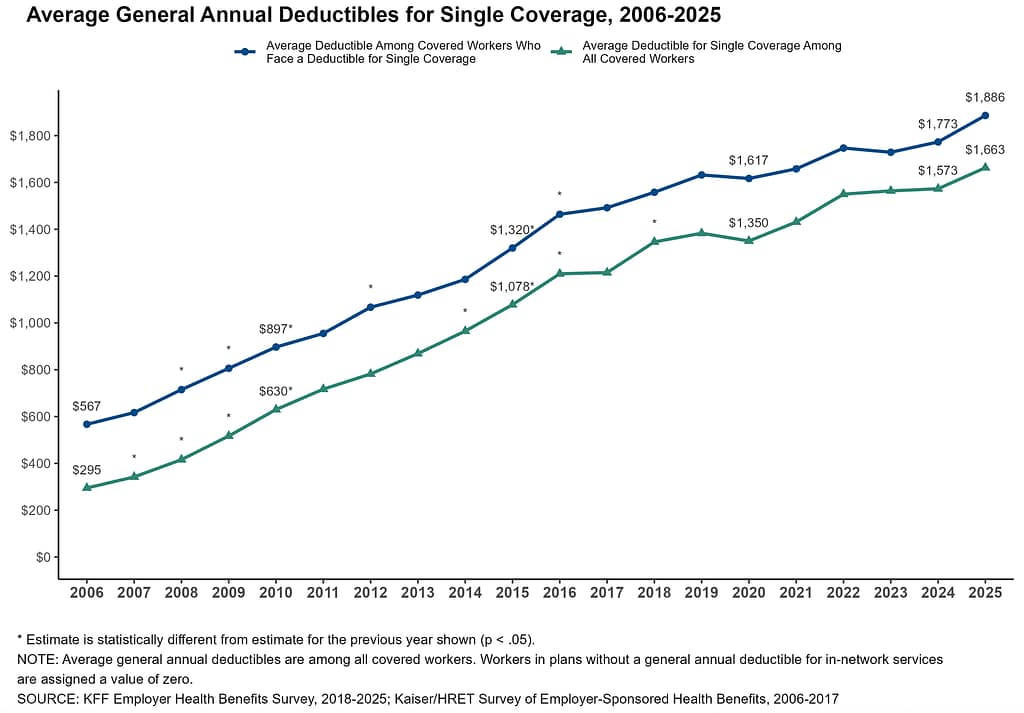

In addition to rising premiums, employees are also facing higher cost-sharing responsibilities when they seek medical services under their plans. The average deductible for single coverage is now $1,886, up $1,617 from five years ago and $1,320 from 10 years ago.

While wage growth has generally kept pace with inflation, the rate of increase of coverage prices has recently surpassed it. Family premiums rose 6% this year, compared with 2.7% inflation and 4% wage growth, meaning the price of coverage grew faster than workers earnings. Over the past five years, wage growth (28.6%) has only slightly outpaced the rise in family premiums (26%) and worker contributions (23%), suggesting that substantial portions of workers’ pay increases are being absorbed by higher health coverage prices, reducing the improvement in take-home income and purchasing power.

Why it Matters for Texas

While the KFF data capture national trends, Texas businesses are feeling the same pressures. Employer-sponsored insurance covers 14 million Texans, making it a critical part of the state’s health care system.

According to a 2024 Employer Healthcare Survey of Texas Employers, 85% of employers say costs are rising at an unsustainable rate, and 51% report those expenses limit their ability to raise wages or hire. About 63% of employers provide health insurance to their employees, while 75% of those who do not cite high premiums as the primary reason. Health benefits remain essential for recruitment and retention, yet 34% cite them as their fastest-growing business expense.

These numbers highlight the significant financial burden rising health care prices impose on our state’s employers and show that this is not just a national problem but is happening right here in Texas.

A Path Toward Affordability and Transparency

For health coverage to remain accessible, prices must be brought under control, and employers must play a central role in shaping solutions. There should be a focus on exposing hidden ownership structures so consumers, and employers understand who controls care. Texas must also make pricing data usable, giving employers clear insight into where health dollars go. These actions will help Texas sustain a competitive economy supported by a healthier, more financially secure workforce.