TX constitutional amendment election: What you need to know

Texans are used to voting in elections for state offices in even-numbered years so that state lawmakers can do their work in the following year. But that glosses over a very important statewide election we have just about every odd-numbered year — the state constitutional amendment election.

Basics

Since 1876, Article 17 of the Texas Constitution has trusted voters with a final say on whether or not proposed amendments ultimately make it in our foundational document. But to kick things off, a proposed amendment is introduced by a state Senator or state Representative as a “joint resolution” that includes three things:

- the word-for-word language that would appear in the constitution

- the language that would appear on the ballot

- the date of the election where voters decide on the amendment

If the House and Senate each approve the joint resolution with a two-thirds supermajority vote, it’s filed with the Texas Secretary of State.

If the House and Senate each approve the joint resolution with a two-thirds supermajority vote, it’s filed with the Texas Secretary of State.

If more than one joint resolution with proposed amendments passes, the Secretary draws lots to determine the ballot order of the different propositions. Sometimes it’s out of a fancy bowl, sometimes it’s out of a cowboy hat. Then it’s their job to get the word out with a plain-English explanation of what these propositions are about.

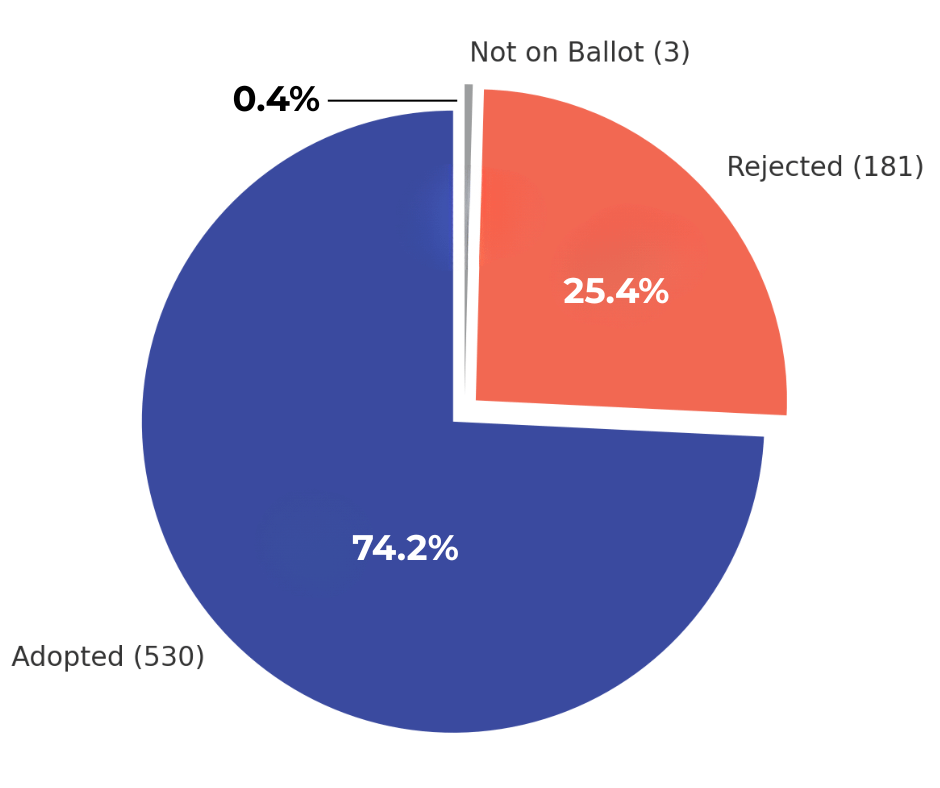

While amendments to the U.S. Constitution are very rare, they’ve become a biennial tradition in Texas. Since 1876, there have been 714 proposed amendments, of which only 181 were rejected by voters (and 3 never made it to the ballot). In total, 530 amendments have made it through the process, meaning nearly 75% of proposed amendments get ultimately adopted.

Why So Many?

This isn’t typical “constitutional” behavior — Texas has one of the longest state constitutions that’s been amended more than nearly any other state. So what gives? There are a few reasons, but mainly they are historical and political.

Texas Constitutional Amendments since 1876

Source: Legislative Reference Library of Texas

Source: Legislative Reference Library of Texas

Historical

Where the U.S. Constitution includes broad statements that have been interpreted to give the federal government sweeping powers, the Texas Constitution envisions a very limited state government. That means even regulating minor issues can require constitutional changes.

Our constitutional amendments typically fall into one of three buckets: small tweaks, big statements, and technical budget and tax laws.

The small tweaks and the big statements are self-explanatory. For example, in 2023 there was a proposed amendment to change the mandatory retirement age for state judges that just tweaked the age listed in the constitution. There are also much bigger statements — another 2023 proposal enshrined a new constitutional right to farm, ranch, and manage wildlife on one’s own property.

But most amendments will fall into the third bucket — technical budget and tax laws. The Texas Constitution includes rules on how property taxes can be assessed and collected, how certain governmental entities can issue bonds, and how the state budget works. So for example, a new property tax exemption for a special population (i.e. seniors) needs its own provision. Likewise, given the strict constitutional limits governing how the state budget works, any special dedicated fund (like the rainy day fund or the state highway fund) often needs its own constitutional provision too.

Political

Lastly, where the bar for amending the U.S. Constitution is exceedingly high, it’s much easier to amend the Texas Constitution. First, out of the hundreds of bills and resolutions that pass each regular session, a number of truly bipartisan measures will hit the two-thirds vote threshold for joint resolutions. Second, it just takes a simple majority of voters in Texas to give a proposed amendment its final approval. If a supermajority of elected lawmakers think it’s a good idea, there’s a good chance that at least a majority of their voters think so, too.

The Upshot

State constitutional amendments can run the gamut — whether it’s adjusting property tax exemptions, creating new rights, or setting aside billions of dollars to invest in future infrastructure needs. These elections in Texas are hugely consequential for the daily lives of Texans and for generations to come.

Stay tuned for an upcoming blog from Jordan Wat, our government affairs director, who will talk about past constitutional elections and voter turnout trends