Texas has a hard-earned reputation of being a low-tax state — there’s no state income tax here, and Texans voted overwhelmingly just two months ago to make it even harder to create one.

Texans pay a lot on property taxes though, a perpetual issue at the legislature— with homeowners worrying that they are being priced out of their homes and businesses concerned that their tax burden is higher than other states.

These two issues show how hard it can be for policymakers, year-in and year-out, to create the right mix of taxes, fees, and other revenue sources for a stable foundation for state finances and economic growth. Up until now, this work has generally been successful — look no further than the state’s roaring economy and low unemployment rate.

At Texas 2036, we’re focused on ensuring that future generations of Texans enjoy a broad and stable revenue base through Texas’ bicentennial and beyond. We see a need to keep a careful eye on the long-term fiscal future, and to support the hard choices state and local leaders will need to make to sustain Texas’ prosperity through the 21st Century.

In some areas, Texas is well-prepared for the future. In others, the legislature needs to take steps to ensure that the state can succeed in the future as it has in the past. Here are some key facts and trends:

There’s far more data where that came from. Those who want to know more should check out A Field Guide to the Taxes of Texas, a comprehensive report from Comptroller Hegar’s office that offers a great overview of the state’s financial picture. There’s also the TexIndex, which compares the state with others in areas ranging from demographics to workforce to state and local finances, and this history of taxes and fees in Texas, which traces the evolution of Texas state revenue sources since 1972.

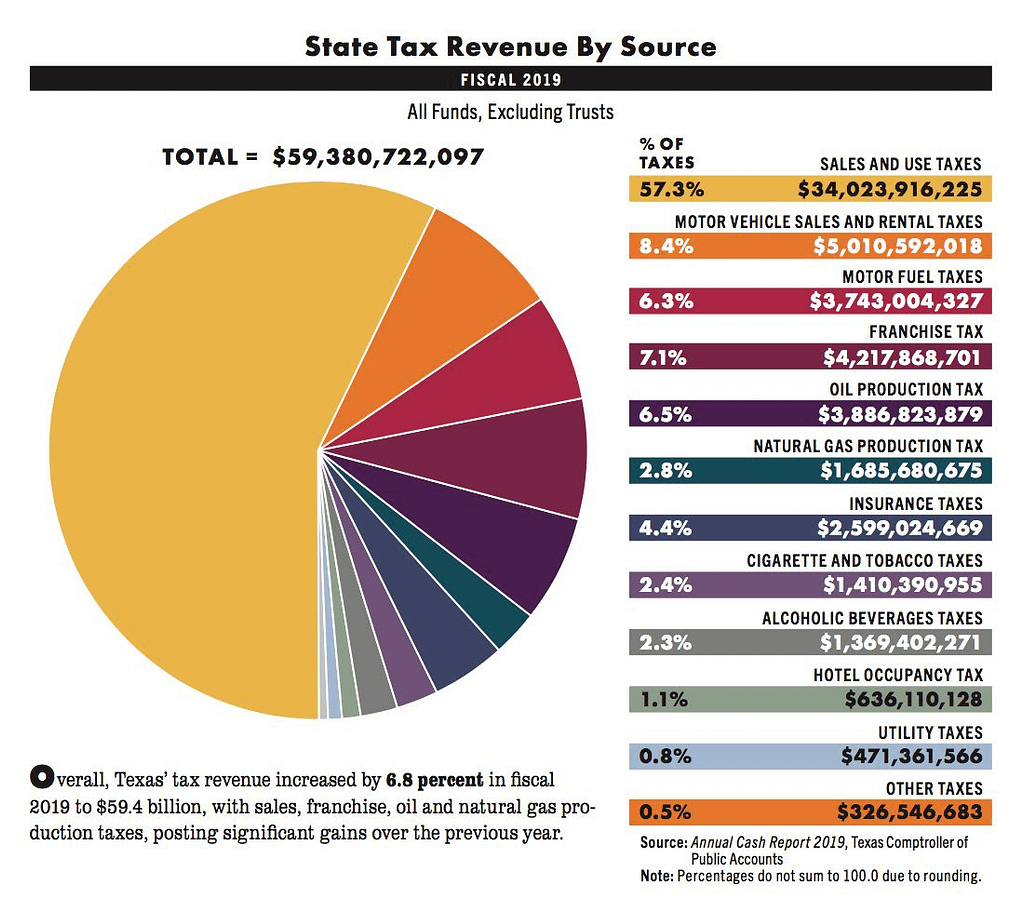

Three key charts from these reports include:

You can expect more data from Texas 2036, as well. That’s because we deeply believe that, for Texas to remain the hub of prosperity and opportunity that it’s been for generations, policymakers will need to be smart about how they’re balancing the state’s finances and economy. We need to be sure that the state is covering Texans’ needs and ensuring that taxes don’t become a drag on employers and investment.

As a data-driven organization, we want to provide information and perspective that fuels a productive conversation about how Texas can continue to support needed investments in infrastructure, education, and future financial obligations, not just keep its head above the rough fiscal waters.

The story of Texas is a great one. With a strong fiscal foundation, it can be even greater.