With the clock ticking on the legislative session, lawmakers have the chance to approve a state employee pension reform plan that would accomplish three primary goals: It would put the state on a path to eliminate the $14.7 billion unfunded liability in the Employees Retirement System (ERS) of Texas; establish a new system with low risk for developing another unfunded liability; and guarantee that all current and future retirees continue to have a dedicated defined benefit pension with a lifetime annuity.

Texas is a growing and diverse state that requires a modern government, with a biannual budget of more than $250 billion. More than 146,000 active state employees take care of critical government services — from law enforcement and corrections to health care and wildlife management — and more than 117,000 former state employees receive retirement benefits through ERS.

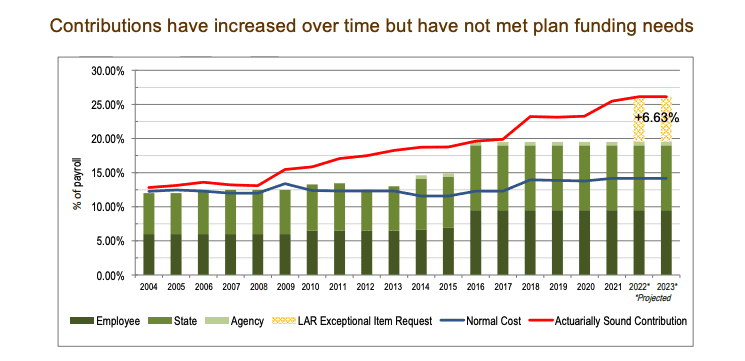

However, the state has not always contributed enough over the past two decades. And today, ERS has a $14.7 billion unfunded liability, which reflects the difference between the total amount of benefits owed to all current employees and retirees and the value of the financial assets the pension plan manages.

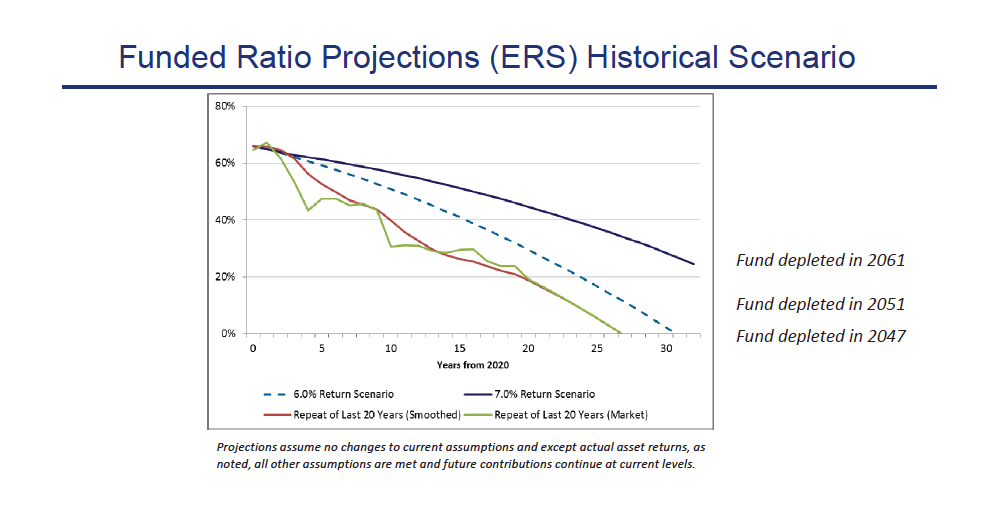

If the Texas legislature does not act this session, this unfunded liability could grow by at least $1.5 billion every two years, and the ERS fund will be on pace to be depleted by 2061.

Comptroller Glenn Hegar and credit rating agencies have warned that the state’s credit rating will also be negatively impacted. While Texas is typically regarded as a state with good fiscal health, on issues of pension debt, the bond rating agencies see red flags. Fitch, for example, ranks Texas in the bottom half of all states (#32) for the ratio of pension liability to personal income. Among peer states – those larger states we compete against for jobs and economic activity – Texas is in the bottom third, next to California.

In 2019, the Texas legislature moved to solve a similar problem with the Teacher Retirement Fund and put it on a path to actuarial soundness. It is critical that lawmakers do the same with this ERS this year – and do so while still protecting current employees, retirees, and beneficiaries.

Proposed Solution

Senate Bill 321 by Senator Joan Huffman and Representative Greg Bonnen has been approved by the full Senate and the House Appropriations Committee, and is headed towards a vote in the House.

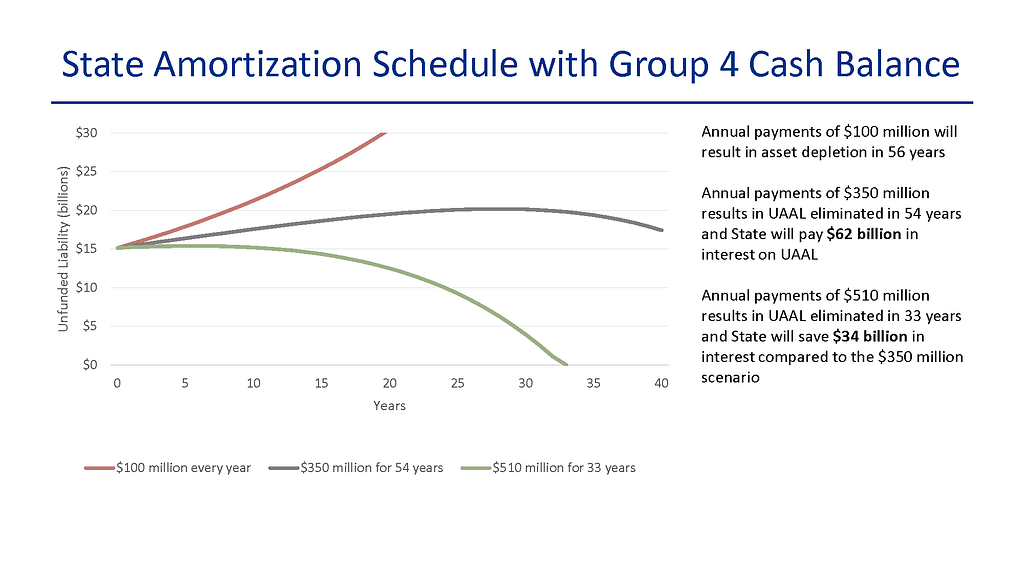

It would start paying down the $14.7 billion through annual amortization payments of $510 million, similar to paying off a loan. These increased payments would save $34 billion in interest over 33 years compared to the original payment plan in the legislation. They would signal to credit rating agencies that Texas pays its debts and guarantee that all benefits that current employees and retirees have earned will be paid in full.

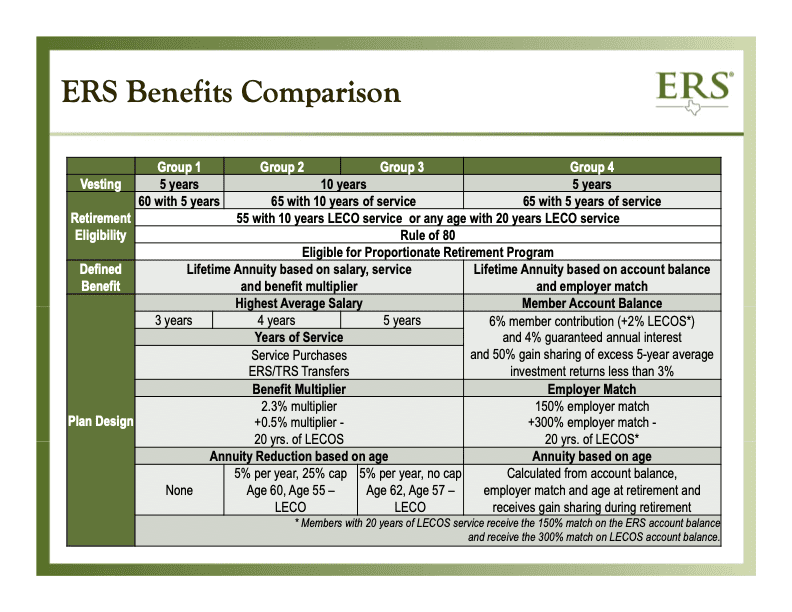

SB321 also makes changes that would provide new state employees, effective September 2022, a “cash balance” defined benefit plan that is similar to the one currently afforded to Texas county and city employees.

SB321 also makes changes that would provide new state employees, effective September 2022, a “cash balance” defined benefit plan that is similar to the one currently afforded to Texas county and city employees.

These future employees in “Group 4” would contribute 6 percent of their salaries to ERS, compared to today’s 9.5 percent contribution — meaning their monthly paychecks will be larger. Employees can choose to use these additional earnings to contribute more to their 401(k)-retirement account (which already exists) or pocket that money for other needs. Their contributions to ERS would be guaranteed to earn between 4 and 7 percent interest every year, and would then be matched at 150 percent by the state when they choose to retire. For a significant number of state employees, this will deliver a more valuable retirement benefit than the current Group 3 plan, especially because Group 4 will be vested in five years as opposed to Group 3’s ten.

The likelihood of another unfunded liability developing under the new plan is extremely low because the new employee benefits and investments will be tied and automatically move together with any adverse or unexpected market changes, rather than relying solely on contributions to make up for any adverse changes.

The likelihood of another unfunded liability developing under the new plan is extremely low because the new employee benefits and investments will be tied and automatically move together with any adverse or unexpected market changes, rather than relying solely on contributions to make up for any adverse changes.

State employees work hard to make Texas a place where everyone has an opportunity to succeed. We need to make sure their retirement plans are working just as hard for them. By taking action this session, Texas lawmakers can help ensure our state employees have a future as bright as Texas.

Source:

Source: