Health price transparency: A timeline and explainer

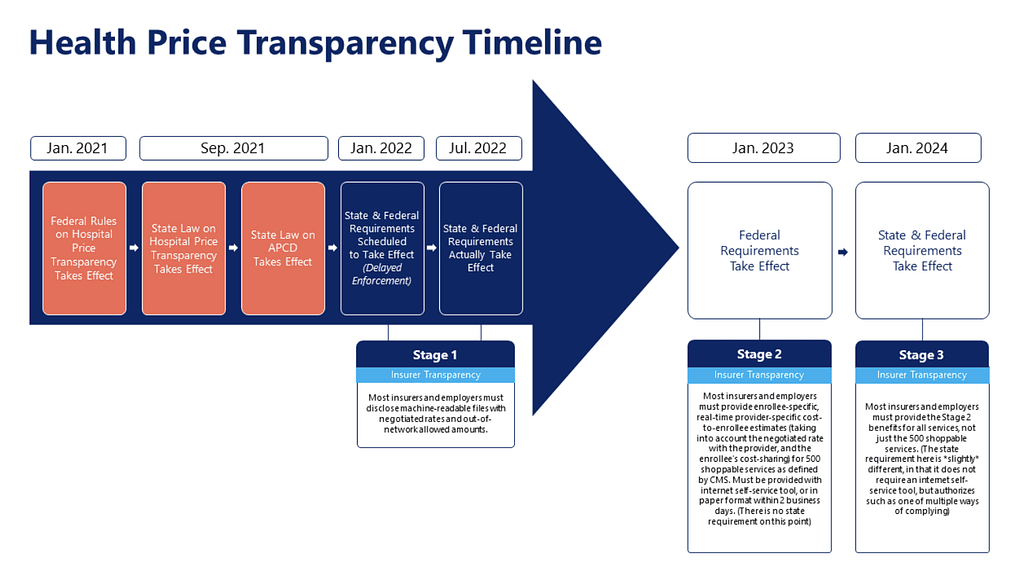

There’s been a lot of talk about transparency in health care lately, and sometimes it can get confusing with all the various laws and rules that have passed. Here I’d like to talk about what’s happened so far, and what is scheduled to happen in the near future. In a subsequent post, I’ll talk about how Texas can build on what’s been done already, and what the next steps are for Texas to really take advantage of this transparency revolution that we’re in the midst of.

If you’d rather listen to me explain this timeline, you can watch the testimony I provided last August to the House Select Committee on Health Reform.

What’s Happened Already?

So far, there are three primary avenues by which transparency is coming to health care:

- rules on hospitals

- the establishment of a state-level centralized claims database

- rules on insurers and employers

1) Price Transparency for Hospitals

First, in January 2021, federal rules took effect requiring hospitals to do two things:

- Post a machine-readable file that lists “standard charges” for all of their services.

- Publicly post information on prices for a set of 300 shoppable services.

While many have focused on the “shoppable service” requirement as a potential tool to encourage consumerism, we believe that the more important aspect is the machine-readable file listing standard charges for all services. While this information won’t be very helpful to most consumers, it can be extremely helpful to employers as they design the health benefit plans for their employees.

Previously, “standard charges” had referred only to their “chargemaster” or “list price.” While this information was better than nothing, it wasn’t helpful for determining what the real price of a service is, because virtually nobody pays the “chargemaster” price. The information that’s truly useful are the real prices that are actually being paid, whether those are the prices negotiated with insurers and employers, or whether they are cash prices being paid directly by patients. The new rules that took effect defined “standard charges” to mean these real, negotiated prices.

Mixed Compliance on New Price Rules

As of April 2022, well over a year after these rules took effect, only 31% of Texas hospitals appeared to be posting compliant machine-readable files with these real prices. Fortunately, by October 2022, that score had nearly doubled, indicating significant progress.

During the last Texas legislative session, lawmakers passed SB 1137 by Senator Lois Kolkhorst and Representative Tom Oliverson. This state law codified the federal rules and created a more stringent penalty structure for noncompliance. While it took some time to implement, the state agency responsible for implementation (Texas Health & Human Services Commission) recently released rules explaining how this new penalty structure will work. While complexly structured, these new rules will dramatically increase the scope of potential penalties for noncompliance. Under the initial federal rules, the maximum possible penalty over the course of a year was $365,000. Under the new state rules, the maximum penalty for noncompliance over the course of a year is nearly $67 million.

2) All-Payer Claims Database

Second, in September 2021, a new state law (HB 2090) establishing an all-payer claims database took effect. UT Health is in the process of setting up a new database that collects health care claims paid by insurers. While the database won’t be able to collect all of the claims due to complicated legal doctrines, it is expected that the database will house nearly two-thirds of claims filed in the state. With this new database, researchers, legislators and even possibly employers will eventually be able to conduct research and studies to identify which medical providers and health benefit plan types are providing the best value to patients. However, there are improvements to rules around permissible research and publication of this data that legislators will have an opportunity to make this session.

3) Price Transparency for Insurers and Employers

Third, as of July 1, 2022, most insurers and employers must post public machine-readable files documenting the provider-specific prices they have negotiated for all medical services and procedures, as well as the “allowed amounts” for out-of-network services. These files are far more expansive than the hospital transparency files, as they include real, negotiated prices for services from all medical provider types, not just hospitals. While this information can be a game changer for employers and governments as they design health benefit plans, the size and complexity of these files will take months to garner useful, actionable insights. Importantly, this means that per federal law, all contractually negotiated prices are public information, and not proprietary information.

What’s Happening Now?

Thus far, transparency requirements have mostly been about large, complex files that are really only useful to data scientists and research nerds. While these disclosures have been important, they haven’t empowered patients with actionable information to take control of their medical spending.

But that may be changing. As of Jan. 1, 2023, insurers must provide their enrollees with consumer-friendly interactive web-based tools to help them compare provider-specific prices and shop for 500 specified shoppable services. These tools must enable a consumer to search for a medical service and see a list of their anticipated out-of-pocket costs specific to each provider. The tools must also enable consumers to sort and filter these lists by price and distance. By Jan. 1, 2024, these tools will require inclusion of all services, not just the 500 specified shoppable services.

For consumers, these tools can finally empower them to make intelligent decisions about where to receive care to control their out-of-pocket expenses. For example, a patient who receives a referral from her doctor to a specialist could pull out her phone, and look up in real time what her expected costs would be for specific specialists, and consult with her doctor about which specialist represented the best value for her. Health benefit plans need to take advantage of this new consumer empowerment and design plans that incentivize and reward their enrollees for making those intelligent decisions.

What’s Next?

In future posts, I’ll talk about what Texas can do to build on these successes and really take advantage of the transparency revolution, and how ultimately, Texas must empower employers — including the state government — to design more innovative health benefit plans that align incentives toward high-value care, saving money for employees, employers and taxpayers.