Employers and employees shoulder an ever-increasing price of health insurance in this country according to data from the Kaiser Family Foundation’s 2021 Employer Health Benefits Survey. In order for employer-sponsored health coverage to regain accessibility and affordability, employers need a stronger voice in negotiating prices and designing benefit plans that align incentives.

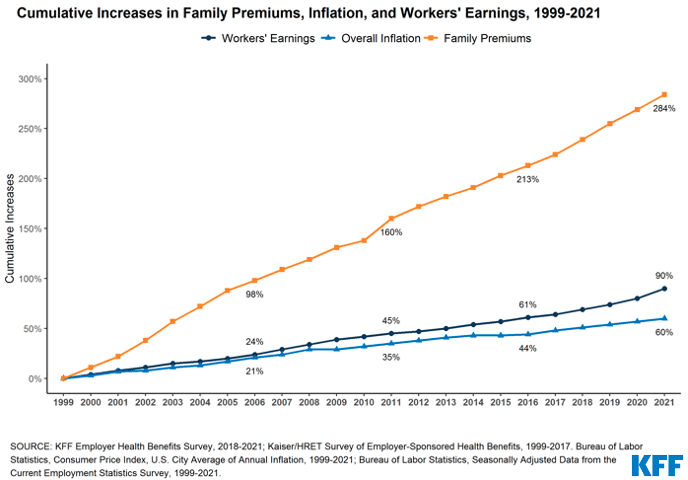

Despite the fact that utilization of health care services dropped sharply during the pandemic, premiums for employer-sponsored health insurance rose 4% last year, nearly double the rate of overall inflation. Since 1999, average total premiums for employer-sponsored health insurance have increased 284%, compared to an overall inflation increase of only 60% over that time period.

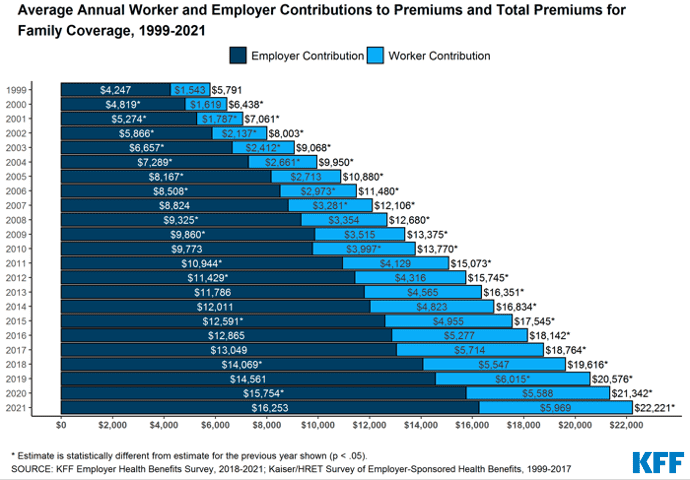

Over the last 20 years, the annual average employee contribution for family coverage has increased by 334%, from $1,787 to $5,969. Average employer contributions for that coverage have increased by 308%, from $5,274 to $16,253.

And despite these large premium increases to both employers and employees, employee cost-sharing responsibilities have increased as well. Average deductibles for individual coverage have increased nearly five-fold since 2006, from $303 to $1,434. This increase reflects both a growing adoption of high deductible plans as well as increased deductibles among those plans.

Prices have risen for over 20 years now, but the increases are not explained by increases in the underlying costs of care. Long-standing research has shown that employers are paying much more than public payers for health care services. However, recent research has also shown that employers who self-fund (but rely on insurers to negotiate contracts with medical providers) pay higher prices than those insurers do when insurance funds are at-risk. Employers that have largely outsourced their benefit plans to third parties have been paying more than they need to for insurance.

Employers can help keep costs under control by pursuing strategies like direct contracting, reference-based–pricing plans, and shared-savings incentives that empower their employees to choose high-value care and reward them monetarily when they do so.

Health care premiums for employer benefits plans have risen over 47% over the past decade – while household income and inflation have both increased less than 20% over the same time period. Nearly half of Texans receive health insurance through an employer. For health coverage to remain accessible, prices must be controlled. And for that to happen, employers need to be a part of the solution.