Texas is on the precipice of transformative changes to how our state provides formula funding to its community colleges. Through the establishment of the Texas Commission on Community College Finance, state leaders and policymakers developed recommendations to better fund and incentivize improvements in students’ education and workforce outcomes across all 50 community college districts.

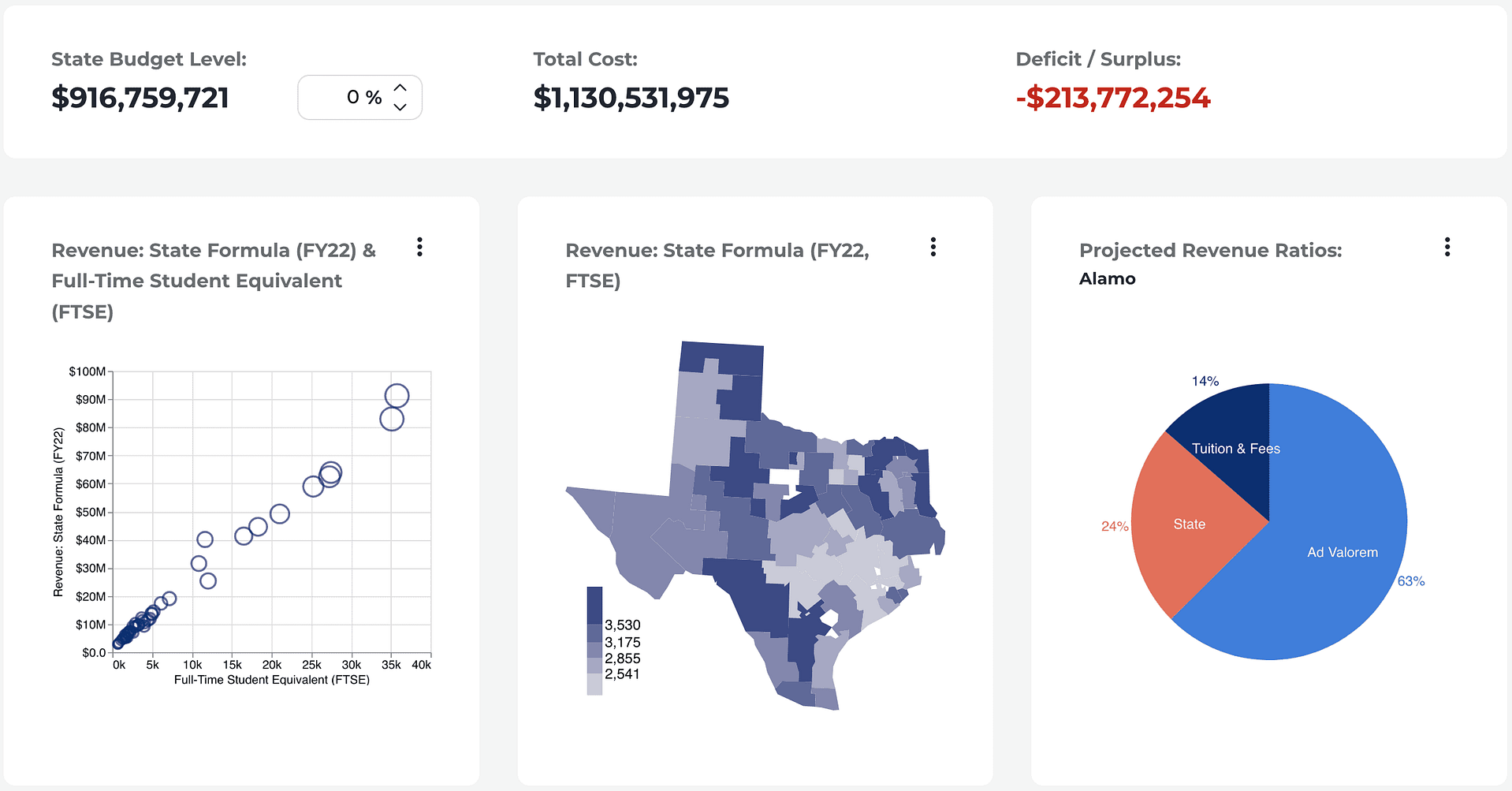

To support the Commission, beginning in 2021, Texas 2036 rolled out a preview of our Community College Finance Simulator Tool and have periodically updated it with potential changes to the state’s finance system. The simulator shows how state funding is allocated to Texas’ community college districts and the financial impacts of potential changes to current policies.

With the filing of House Bill 8 and Senate Bill 2539, identical companion bills seeking to enact the Commission’s recommendations, the newest, enhanced version of the tool released last month allows users to see how the state and community colleges might be impacted from different policy decisions made in the state’s community college finance system.

With the filing of House Bill 8 and Senate Bill 2539, identical companion bills seeking to enact the Commission’s recommendations, the newest, enhanced version of the tool released last month allows users to see how the state and community colleges might be impacted from different policy decisions made in the state’s community college finance system.

Model of Texas Commission on Community College Finance Recommendations

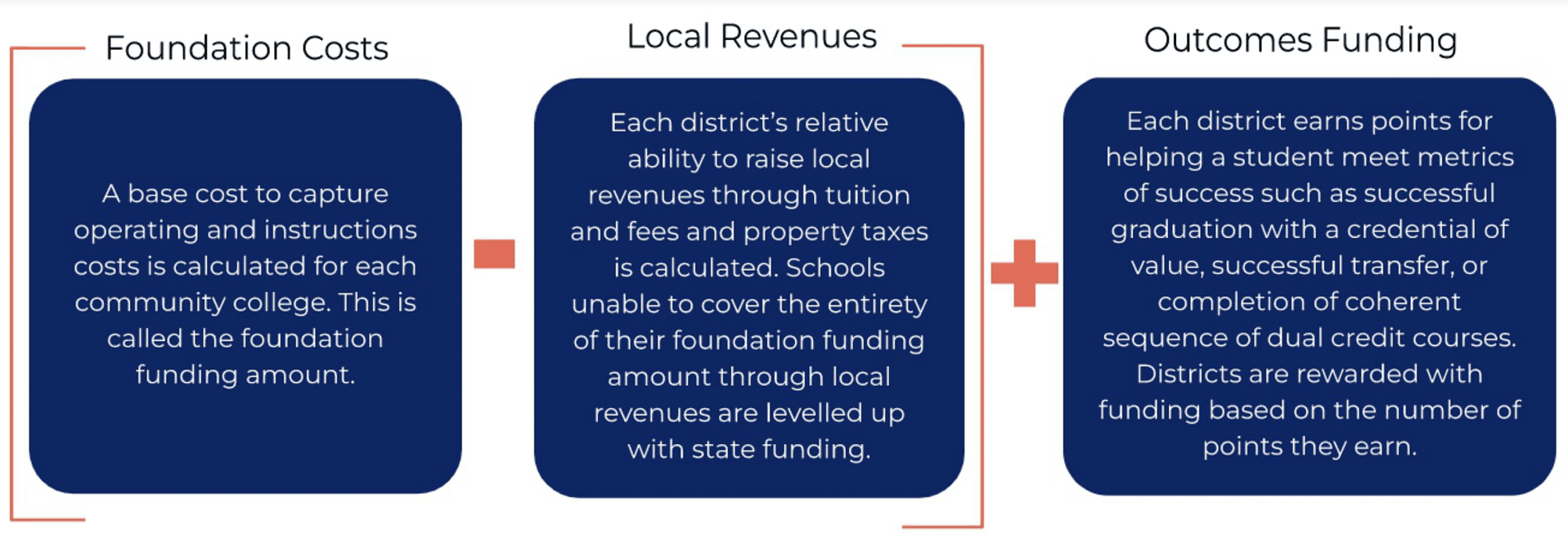

Specifically, in the newest version of the simulator, each district’s appropriation from the new formulas recommended by the Commission — the Guaranteed Yield formula and the Outcomes-Based formula — can be calculated based on decisions set by users. Policy variables within the model include:

- Determination of a district’s Guaranteed Yield appropriation through calculations of their instructional and operations costs and accounting for local revenue-raising efforts such as through property taxes and tuition and fees;

- Adjustments for outcomes-based funding student success metrics including the number of credentials earned overall and credentials earned in high-demand fields, number of transfers to four-year postsecondary institutions, and students completing a coherent sequence of dual credit courses that meet academic program requirements; and,

- Setting weights for students who meet the above outcomes who are economically disadvantaged, academically disadvantaged and/or adult learners.

The simulator uses historical data to allow users to compare the financial impacts of different policy decisions for fiscal year 2022. As such, the estimates users see should not be treated as financial projections for future fiscal years.

HB 8 and SB 2539 seek to make better workforce alignment of postsecondary educational programs a priority for our state’s community college finance system. Learning about how different funding proposals can achieve this broad goal and impact our college districts and state’s budgets is an important step in the state legislative process. The Texas 2036 Community College Finance Simulator Tool provides the public with the ability to create and explore the various funding proposals that the Texas Legislature could consider this session.