The following written testimony about workforce-aligned recommendations by Texas 2036 Policy Advisor Renzo Soto was delivered to the Texas Commission on Community College Finance on Sept. 12, 2022.

What to know:

- Texas 2036 firmly supports the recommendations of the Texas Commission on Community College Finance that deliver value to students and employers.

- Ensuring that Texans can obtain a job that pays a self-sufficient and family- sustaining wage through the completion of postsecondary education or training should drive the state’s community college finance system.

- All community colleges should have access to the resources necessary to improve and grow the outcomes of Texas students, including disadvantaged students, in order to meet statewide and regional workforce needs.

- Texas 2036 will use its online, public finance simulator to model the Commission’s final recommendations.

The importance of postsecondary education and its impacts on job attainment was pronounced during the COVID-19 pandemic. While job growth before the pandemic was concentrated in lower wage jobs, it shifted between 2019 and 2021 towards skilled jobs, like management and business/financial operations jobs.

Texans must have the required education or training to access these jobs to enjoy the higher wage premiums that typically come with them. As highlighted in the state’s Building a Talent Strong Texas plan, this means supporting more Texans to complete postsecondary education given that 62% of all Texas jobs will require such an education by 2030.

Community colleges can help efficiently meet employers’ current demands for skilled labor, while building the capacity needed to expand our future pipeline and meet our state’s changing workforce needs. Texas community colleges still. served over 668,000 students, or 45.2% of higher education students, last fall despite steep enrollment declines. With nearly every Texas county served by a community college district, and open enrollment policies for both academic and workforce programs, colleges are accessible means for Texans to get the skills they need for a job that will earn them a self-sufficient, family-sustaining wage. Texas 2036 supports the recommendations released by TXCCCF, especially the formula recommendations as the structure can be used to better align the actual needs of Texas employers with community college programs.

The outcomes of community college students are key to ensuring value for both Texans and employers, which must be reflected by the state’s finance system.

The share of high-wage jobs paying at least $65,000 annually held by Texans with a high school diploma or below dropped from 51% to 11% over the last decade. At the same time, Texans with a certificate or degree, or simply some education or training after high school, became more likely to have a high-wage job. As such, the TXCCCF’s recommendation to distribute the majority of state funding based on student outcomes, with additional support for disadvantaged students, should have material and equitable impacts on students’ abilities to obtain a good-paying job.

We encourage the TXCCCF to maintain its priority on measuring ultimate outcomes – specifically, credentials of value completion and successful transfer. Incentives for credentials of value aligned with high-demand fields, both credit and non-credit, will be particularly beneficial in filling employers’ labor needs. One possible methodology to measure program alignment with workforce needs was developed by the THECB’s Formula Advisory Committees (FAC) to determine “targeted fields”, which are college programs linked to the top occupations found in the state’s higher education regions and paying more than the state median wage. We found that 31% of credentials conferred by community colleges in the 2019-2020 academic year were tied to the targeted fields recommended by the FAC. This is a strong foundation that colleges can build on through a finance system that provides predictable funding rewarding further alignment with workforce needs.

One consideration is to eventually transition from the state median wage to determine targeted fields to the self-sufficient wage that is currently being calculated by the Tri- Agency under HB 3767 (87-R). This wage is defined as one high enough for a Texan and their family to meet basic needs without state public assistance, and it is required to be calculated for every Texas county. Tying targeted fields to self-sufficient wage levels would elevate the potential return-on-investment for Texas students while recognizing the varying levels of basic needs costs throughout the state – all while continuing to meet workforce demand.

Another consideration is to link the incentive for transfer students to their persistence at a 4-year university. Although the transfer of a student is certainly a marker of success for community colleges, it is important that the transfer student succeed at the university-level as well. This is particularly the case for students who may not have earned a credential of value upon transferring. Should they fail to persist and complete at the university, these students are at risk of having diminished returns – or, worst, no return – for their higher education investment. However, an incentive for the successful transfer and persistence of a student can ensure that the student is as best prepared for a baccalaureate program as possible before they transition to a university.

Incentivizing students’ outcomes to address workforce needs will require supporting districts without access to the same resources as their peers.

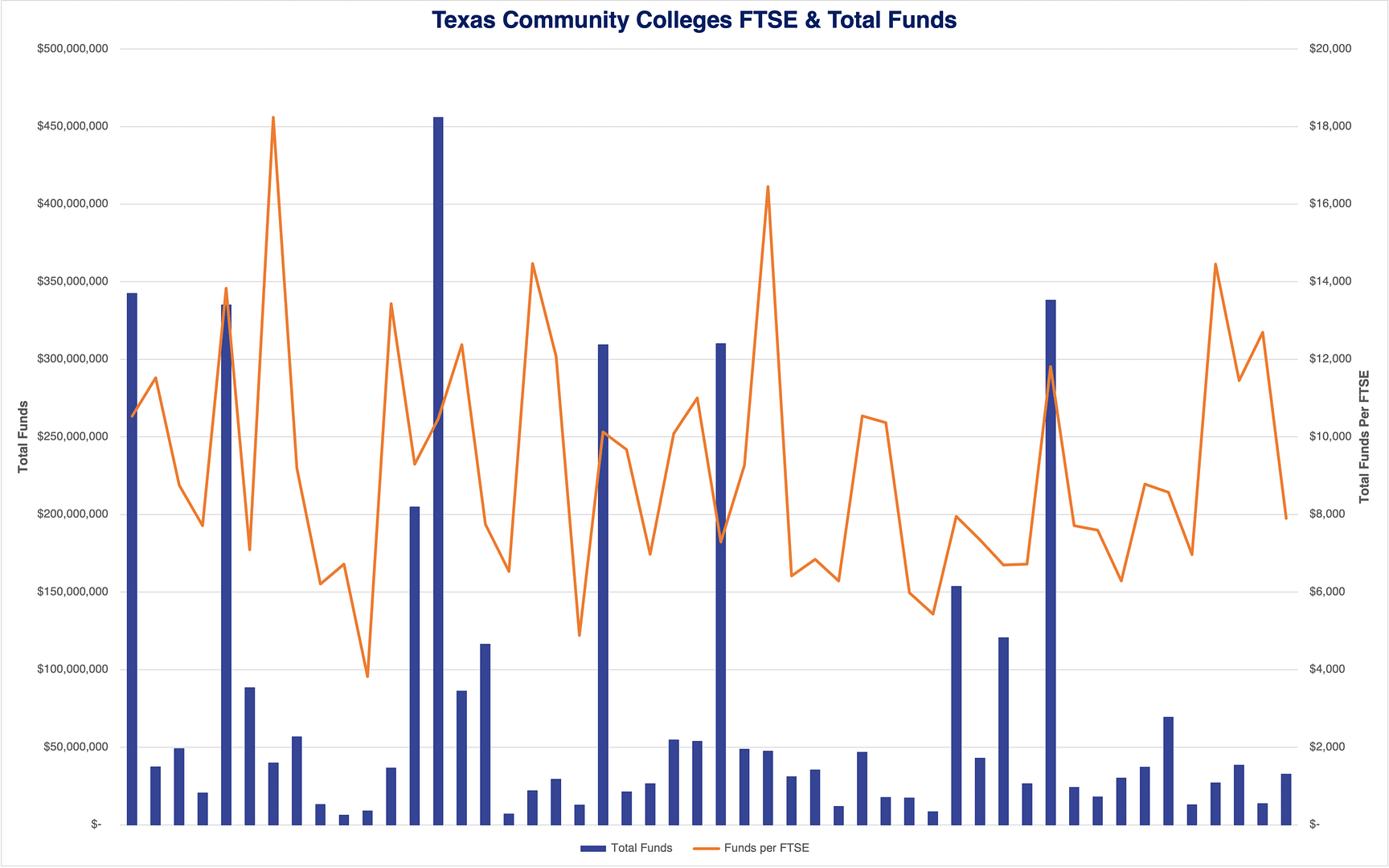

Each Texas community college is different from its peers in terms of the students they serve and the resources they have available to serve those students. We are supportive of the TXCCCF’s recommendation to drive state support through the outcomes-based formula. However, there are districts who may lack the resources needed to grow their outcomes and better support their students relative to other districts. When considering state appropriations, tuition and fees, and property tax collections, there is about a $14,420 differential between the two colleges with the highest and lowest dollar per full- time student equivalent – both of which serve around the same number of students.

As such, we support the TXCCCF’s focus on providing sufficient foundational funding specifically for colleges with low available tax bases and/or student enrollments. This will help provide all Texans with access to a high-quality postsecondary education. Community College Annual Reporting & Analysis Tool, THECB Basis of Legislative Appropriations 2022-2023, Sources and Uses Detail FY 2021.

As such, we support the TXCCCF’s focus on providing sufficient foundational funding specifically for colleges with low available tax bases and/or student enrollments. This will help provide all Texans with access to a high-quality postsecondary education. Community College Annual Reporting & Analysis Tool, THECB Basis of Legislative Appropriations 2022-2023, Sources and Uses Detail FY 2021.

In calculating foundational funding levels for each district, we support the TXCCCF’s recommendation to account for the needs of student populations requiring additional support services and the needs of small colleges. In the 2019-2020 academic year, 30.5% of enrolled community college students received a Pell Grant, 9.2% were first- time students and did not meet college readiness standards through the Texas Success Initiative, and 29.1% were adult learners aged 25 or older. Factoring in the unique needs of these student populations helps ensure that all districts have the resources needed to focus on their students’ outcomes. For example, for the Fall 2014 cohort of community college students, only 25.7% of students who were enrolled and identified as not college ready earned a degree or certificate within 6 years. Improving these student populations’ outcomes will be key to grow the state’s pipeline of skilled workers.

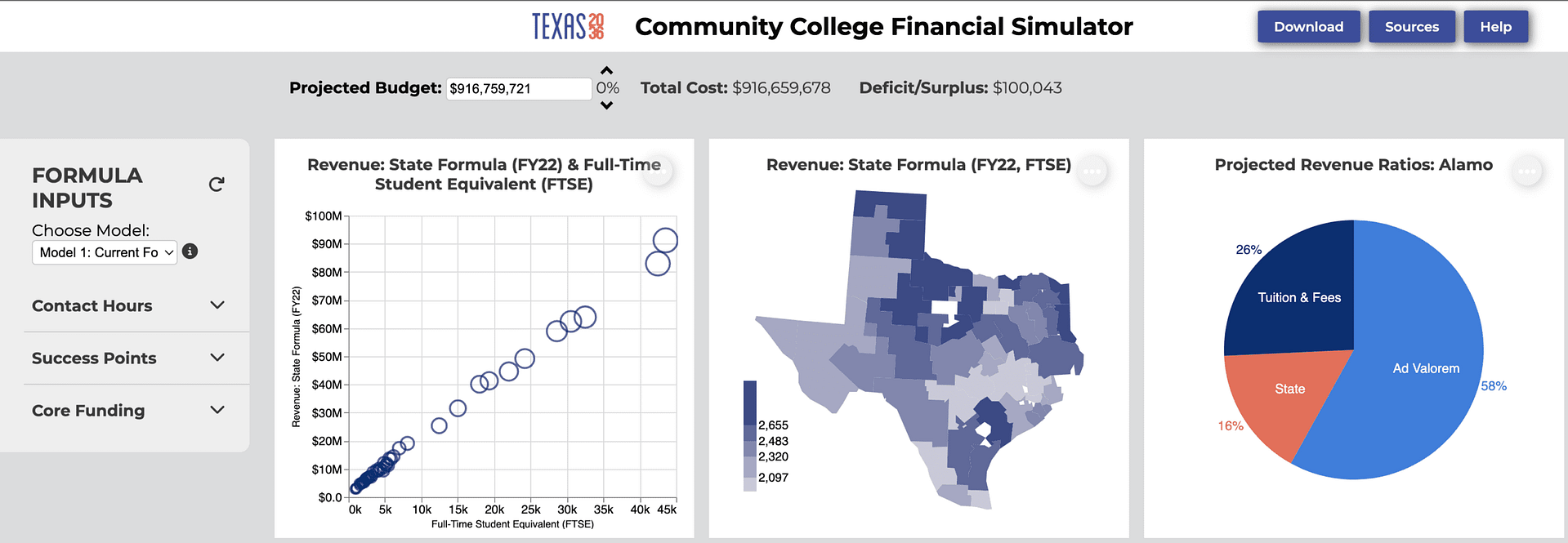

Community College Finance Simulator

The Texas 2036 Community College Finance Simulator currently has the data needed to explore parts of the TXCCCF’s recommendations, including district-by-district percentages of disadvantaged students and the availability of revenue through state appropriations, tuition and fees, and property tax collections. In partnership with the University of Texas at Dallas, data has been obtained through the Texas Education Research Center, which provide secure and privatized access to longitudinal, student- level data reported by Texas education institutions. For the remainder of the year, Texas 2036 will acquire the data necessary to model the TXCCCF recommendations, allowing for comparison simulations. The simulator can be accessed at: texas2036.org/ccfinance.