Texas 2036 submitted the following comments on the Texas Department of Insurance’s informal rule on SB 1296 (87R).

Background

Texas 2036 supported the creation of Chapter 1698 of the Texas Insurance Code (SB 1296 [87R]). Prior to last legislative session, we contracted with an actuarial firm to conduct an assessment of the impact of this chapter on the Texas insurance market, which concluded that successful implementation could lead to an additional $1 billion in federal marketplace subsidies made available to Texans and resulting in more than 200,000 additional uninsured Texans gaining coverage with detriment to neither Texan insurance carriers nor the Texas budget.

However, these results are premised on the law’s provisions – most importantly Section 1698.052(c) of the Insurance Code — being effectively implemented. We submit these comments therefore with the aim of assisting in the effective implementation of the law and, correspondingly, achievement of the bill’s principal purposes: improved consumer purchasing power, and increased competition and stability in the individual insurance market. We appreciate the vital work and service that TDI provides to our state, and am grateful for the opportunity to work with the Department.

Legal Requirements

The new law, Tex. Ins. Code Sec. 1698.052(c), requires that when reviewing rate filings for qualified health plans (QHPs), the commissioner consider the (i) relative differences in premium rates by metal tier, (ii) use of specific induced demand factors, and (iii) ability of subsidized consumers to afford the policy – i.e., to purchase coverage and pay out-of-pocket costs. This section of the statute is the most critical part of Chapter 1698, both in terms of increasing access to coverage and creating a competitive and stable individual market.

In order for the law to be effectively implemented, insurance carriers will require clear rules and guidelines which, when followed, will reduce distortive pricing practices that are having a detrimental effect on both consumer affordability and the insurance market itself. Texas 2036, based on our own evaluation as well as on discussions with industry stakeholders and actuarial experts, believes that the informal rule – and the submission templates referenced by the informal rule – recently released by TDI lack sufficient specificity and clarity, and therefore are unlikely to effectuate the policy aims of Chapter 1698.

Recommendations

TDI should develop and issue clear guidance to accompany the rule that directs health plans offering products in the individual ACA market to use appropriate and consistent rating factors and assumptions, as other states have. Useful state models include successfully implemented rate review provisions in Pennsylvania and New Mexico. In those states, the Department, after conducting an actuarial review, provided carriers with a specific ratio that must be met in order to comply with the rate relativity requirements of the statute. A similar approach with respect to §1698.052(c) would require as a first step an actuarial study of the Texas marketplace. The study would have a relatively small cost – perhaps a few tens of thousands of dollars; the potential benefits in the form of optimized federal subsidies, in contrast, could total over $1 billion for Texan consumers.

Regulatory guidance establishing clear benchmarks will provide carriers greater certainty, improve compliance, add stability to the marketplace, and increase consumer purchasing power. And by increasing consumer purchasing power, carriers and providers will benefit from increased enrollment in the Texas individual marketplace.

Specific Requests

Specifically, the Department should direct health plans offering products in the individual ACA market to develop premium rates for specific plans using Actuarial Value and Cost Sharing Design of

Plan Factors that reflect only:

- Paid-to-allowed ratios that are developed using the same standard population for each plan and are relatively consistent with the Actuarial Value Metal Values developed for the plans;

- Induced demand factors by Metal Level and Silver on exchange plan variant that are prescribed by the state; and

- A common “CSR Defunding Adjustment” to reflect the enhanced coverage generosity of Silver plans due to the federal government not reimbursing insurers for cost-sharing reduction (CSR) payments.

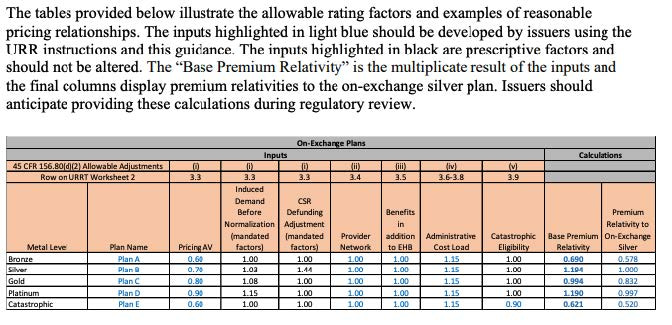

Examples of Effective Implementation in Other States

The following two examples may assist with the task of developing guidance for carriers in Texas.

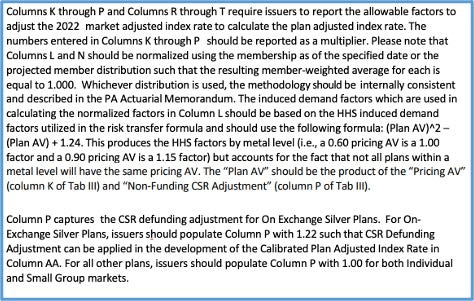

First, the New Mexico Department expressly prescribes the Induced Demand factors and CSR Defunding Adjustment factors.

The Pennsylvania Department did not provide an example template in their guidance document, but they did provide clear instructions to carriers on factors to be addressed in their rate submission:

The Pennsylvania Department did not provide an example template in their guidance document, but they did provide clear instructions to carriers on factors to be addressed in their rate submission: