A quick guide to Texas’ state budget

This is a preview of the 100th edition of our Texas 2036 newsletter diving deeper into the spending priorities of our state government — its state budget. To receive this weekly look at our work, sign up here.

State Budget 101: How are tax dollars spent in TX?

Every session, the Texas Legislature has one bill that they must pass – the state budget.

Here’s your quick guide to what the budget is, how it’s created and what we’d like to see in the next budget for the 2026-27 budget cycle.

What is the state budget and how does it work?

The budget directs how the state spends its revenue each two-year budget cycle, whether from tax collections, federal payments or fees and fines.

In other words, the state government can’t continue to work without the budget’s authority to spend money. Also, lawmakers through their budget work express the state’s priorities for spending taxpayer dollars.

💵 Did you know? Sales tax is the largest source of state funding for the state budget, accounting for 58 percent of all tax collections.

Where are your tax dollars spent?

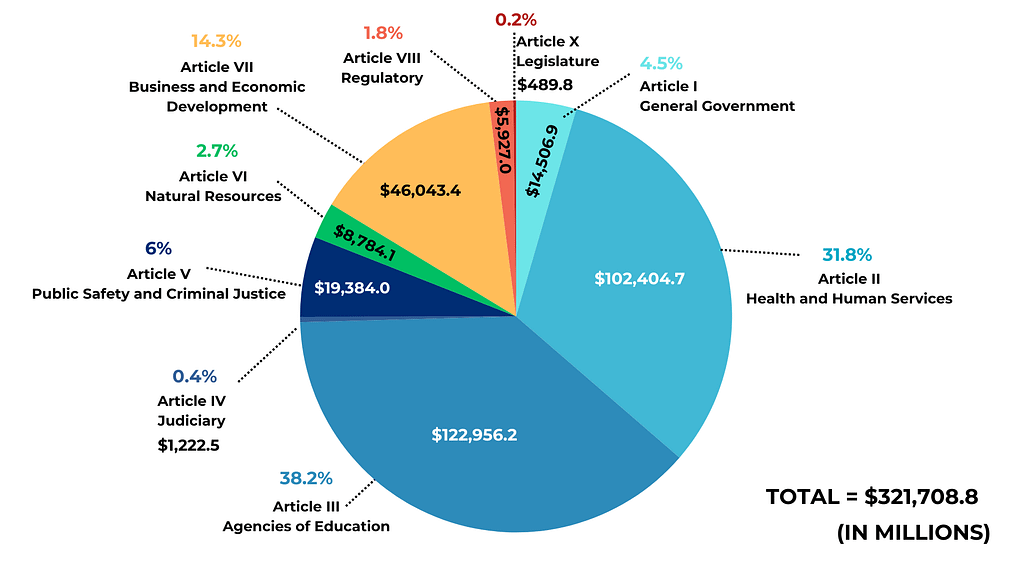

The current two-year Texas budget is $321.7 billion from all revenue sources, with health and human services and education accounting for 70% of the budget.

Funding by Article, All Funds (2024-25 Biennium)

Source: Legislative Budget Board

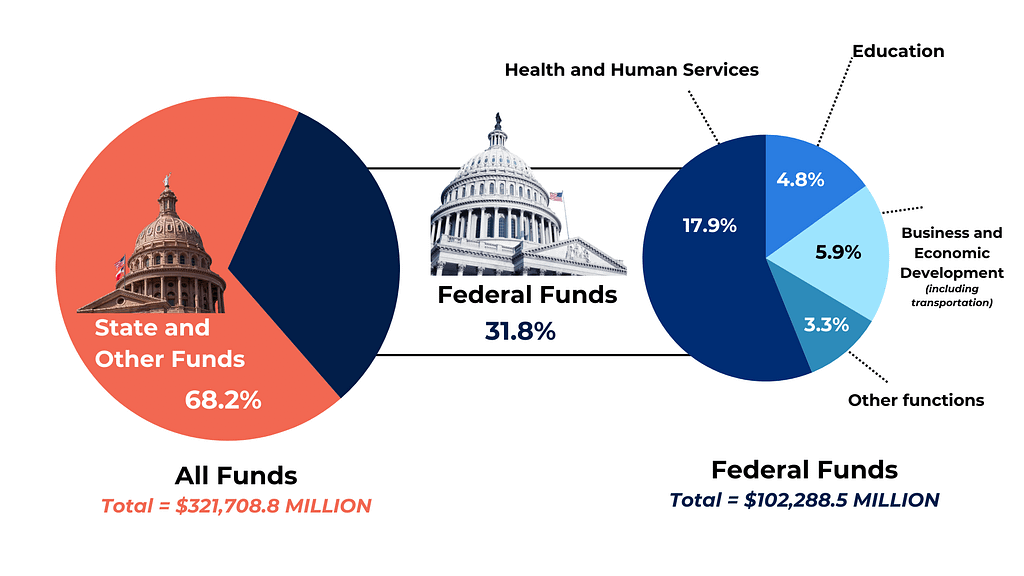

Federal funds account for over $102 billion in the state budget. Most of that federal support goes to health and human services programs as well as transportation and education programming, to a lesser extent.

Did you know? At the state level, Texas collects the most tax revenue from these sources:

- sales taxes

- business franchise tax

- motor vehicle-related taxes

- taxes on crude oil and natural gas production

Federal Funds As Percentage of All Funds (2024-25 Biennium)

Source: Legislative Budget Board

The Big 10: What are the state budget articles?

Spending in the state budget is categorized into 10 areas, largely corresponding to the various duties performed by the state government.

Here are those 10 budget articles:

Article I: General Government — Covers executive-branch elective offices, including those established by the Texas Constitution such as the Office of the Governor, the Comptroller of Public Accounts, and the Office of the Attorney General.

Article I: General Government — Covers executive-branch elective offices, including those established by the Texas Constitution such as the Office of the Governor, the Comptroller of Public Accounts, and the Office of the Attorney General.

Article II: Health and Human Services — Covers caseloads for Medicaid, the Children’s Health Insurance Program (CHIP), and child protective services. Also includes mental health services and programs to protect public health.

Article II: Health and Human Services — Covers caseloads for Medicaid, the Children’s Health Insurance Program (CHIP), and child protective services. Also includes mental health services and programs to protect public health.

Article III: Education — Covers the public education system serving 5.4 million students enrolled in 8,094 campuses and 872 charter school campuses as well as the state’s system of public higher education, including 37 general academic institutions and 50 community college districts.

Article III: Education — Covers the public education system serving 5.4 million students enrolled in 8,094 campuses and 872 charter school campuses as well as the state’s system of public higher education, including 37 general academic institutions and 50 community college districts.

Article IV: The Judiciary — Covers the state’s court system, which includes the Supreme Court of Texas, the Court of Criminal Appeals, Courts of Appeals, and trial courts.

Article IV: The Judiciary — Covers the state’s court system, which includes the Supreme Court of Texas, the Court of Criminal Appeals, Courts of Appeals, and trial courts.

Article V: Public Safety and Criminal Justice — Covers the adult and juvenile corrections systems, law enforcement and highway patrol, the Texas military forces, and driver license processing.

Article V: Public Safety and Criminal Justice — Covers the adult and juvenile corrections systems, law enforcement and highway patrol, the Texas military forces, and driver license processing.

Article VI: Natural Resources — Covers agencies charged with the responsibility of influencing the management and development of the state’s natural resources, such as agriculture, water and oil & gas.

Article VI: Natural Resources — Covers agencies charged with the responsibility of influencing the management and development of the state’s natural resources, such as agriculture, water and oil & gas.

Article VII: Business and Economic Development — Covers agencies that provide services supporting transportation, business and workforce development.

Article VII: Business and Economic Development — Covers agencies that provide services supporting transportation, business and workforce development.

Article VIII: Regulatory — Covers regulated industries like insurance, health-related occupations, telecommunications, electric utilities, securities and professional licensing.

Article VIII: Regulatory — Covers regulated industries like insurance, health-related occupations, telecommunications, electric utilities, securities and professional licensing.

Article IX: General Provisions — Covers provisions that apply broadly to all or multiple articles of the state budget, including items like state employee classifications and salary schedules.

Article IX: General Provisions — Covers provisions that apply broadly to all or multiple articles of the state budget, including items like state employee classifications and salary schedules.

Article X: Legislature — Supports operations of the Texas House and Texas Senate and other legislative entities, such as the Legislative Budget Board, Legislative Council, State Auditor’s Office and Sunset Advisory Commission.

Article X: Legislature — Supports operations of the Texas House and Texas Senate and other legislative entities, such as the Legislative Budget Board, Legislative Council, State Auditor’s Office and Sunset Advisory Commission.

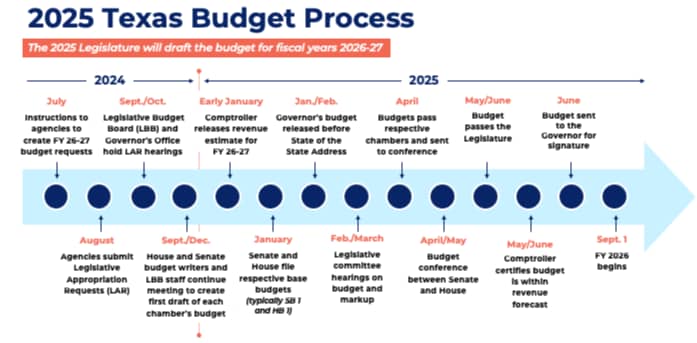

Writing the budget is a year-round activity

As you might imagine, writing a budget as large and complex as the Texas state budget requires more than just the 140 days allocated every other year for each Legislature’s regular session.

In fact, the budget writing process takes a full year to do. State agencies compiled their budget requests this summer, which are currently being evaluated by the Legislative Budget Board.

Budget writers will likely be able to count on a revenue surplus again as they set their funding priorities ahead of the next legislative session.

The Comptroller’s Office currently projects a $21.2 billion fund balance for the upcoming fiscal biennium.

While lower than the record $32.7 billion fund balance ahead of the 2023 legislative session, lawmakers will no doubt be helped by another session that begins with a healthy cash balance.

In addition, the Comptroller’s Office projects the balance in the Economic Stabilization Fund, aka the Rainy Day Fund, to grow to $23.8 billion, providing another source of funds to deal with future fiscal emergencies.

Texas 2036: Budget priorities

State lawmakers’ budgetary choices have a big impact on Texas 2036’s policy work, whether it’s readying schoolchildren to enter college or a career, ensuring the state’s basic infrastructure can support a state booming in both its population and its economy or extending opportunities for all Texas families.

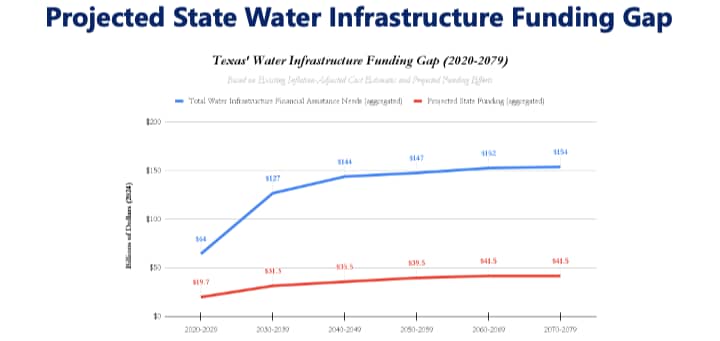

Here are a few of our priorities for the next state budget:

- Creating a dedicated revenue stream to address water infrastructure;

- Fully funding newly implemented community college finance reforms;

- Information technology and staffing to fully operate the Texas All Payors Claim Database;

- Child care and workforce data modernization at the Texas Workforce Commission;

- Increasing access to high-quality math professional development; and

- Improving judicial data systems

How well do you know Texas’ state budget?