Glossary of Terms

Coverage Gap – The “coverage gap” refers to a group of low-income individuals who are ineligible for any government assistance in obtaining health insurance coverage. It is referred to as a “gap” because these individuals earn too much to qualify for Medicaid coverage (more than 14% of the Federal Poverty Level), but not enough to qualify for subsidies on the ACA Individual Market (between 100% and 400% of the Federal Poverty Level). In Texas, Kaiser Family Foundation estimated that there were 691,000 Texans in the Coverage Gap in 2018.

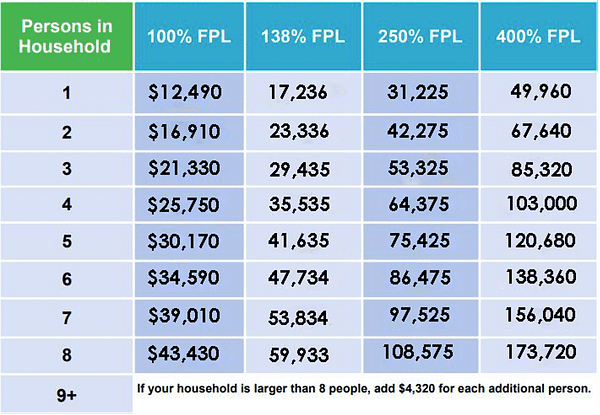

Federal Poverty Level (FPL) – An amount set by the Federal Government each year based on the cost of living. Eligibility for various programs, including Medicaid, and subsidies on the ACA Individual Market are based on income thresholds as a percentage of the FPL. The FPL varies based on household size. The table below summarizes various FPL percentages based on household size.

Benefit cliff / Subsidy Cliff – In general, a benefit cliff exists in income-eligiblity programs where $1 dollar of income can have a dramatic difference in an individual’s eligibility for a program. Such cliffs are undesireable because they can provide disincentives for individuals to earn more money because the value of the benefit they would lose is worth more than the amount of extra money they could earn.

- In the context of ACA subsidies, such a “cliff” exists at 400% of the FPL. Because the ACA’s subsidy amounts are calculated on a sliding scale of income the cliff is less extreme than if the subsidy amounts were flat, but individuals earning $1 more than 400% of the FPL lose all eligibility for subsidies. One of the 1332 Waiver options we have modeled reduces the impact of this cliff.

- Such a cliff also exists with the Medicaid program. Because the Medicaid program is an all-or-nothing benefit, individuals who earn $1 more than the eligibility standard become ineligible for the program. In the current environment, many of these individuals who earn too much fall off the cliff into the “coverage gap.” If the coverage gap were bridged by expanding Medicaid eligibility standards, these individuals would lose coverage for Medicaid, but become eligible for ACA subsidies.

MEDICAID

Medicaid – In Texas, Medicaid offers health coverage to low-income citizens and legal permanent residents who are either pregnant, responsible for a child 18 years of age or younger, blind, have a disability or a family member in the household with a disability, or are 65 years of age or older. The Federal Government pays approximately 60% of the cost of the Medicaid program currently in Texas. Most low-income adults who are “able-bodied” (i.e., able to work) are currently ineligible to receive Medicaid benefits, with exception of the very poorest (below 14% of the Federal Poverty Level or FPL). Many of these individuals have an income that is too low (below 100% of FPL) to receive federal marketplace subsidies under the Affordable Care Act, leaving them underserved in a “coverage gap”.

Medicaid Expansion – Under the Affordable Care Act (ACA), in 2014 the Federal Government began providing a generous federal funding match to states that expanded their Medicaid eligibility standards. For states that expand eligibility to include individuals who earn 138% or less of the Federal Poverty Level, the Federal Government will cover 90% of the cost, with the state responsible for the remaining 10%.

Takeup Rate – The take-up rate for Medicaid Expansion is an estimate of how many people that are eligible for the program will sign up for it. Estimates for this vary widely. Our model includes a complex calculation of take-up rates for different groups of individuals, such as individuals who currently have private insurance, and individuals who are currently receiving specific Medicaid services but would become eligible for full Medicaid under an Expansion. The take-up rate that can be user-modified is for the population of individuals who are currently uninsured, are not receiving any Medicaid services, and would become eligible under expansion. Our model currently estimates that population to be 824,621. Learn more about how we calculated take-up rates here. [Link to Our Model]

1115 Waiver – Section 1115 of the Social Security Act gives the Secretary of Health and Human Services authority to approve experimental, pilot, or demonstration projects that are found by the Secretary to be likely to assist in promoting the objectives of the Medicaid program. The purpose of these demonstrations, which give states additional flexibility to design and improve their programs, is to demonstrate and evaluate state-specific policy approaches to better serving Medicaid populations.

- In the context of options to reduce the uninsured rate, an 1115 Waiver could be requested in order to allow Texas to create its own type of health coverage program for low-income individuals. Some alternatives to Medicaid Expansion that have been discussed in Texas include modified general expansions, as well as targeted expansions. A modified expansion might expand eligibility to an income threshold lower than 138% of the Federal Poverty Level (FPL) – we model what setting eligibility at 100% of the FPL would look like – or include components similar to private insurance designed to incentivize personal responsibility like premiums and co-pays. A targeted expansion would offer coverage to groups of low-income individuals with specific medical needs, such as post-partum women or individuals with serious mental illness. Importantly, if a coverage program does not expand general eligibility to individuals with incomes below 138% of the FPL, it is unlikely that the Federal Government would agree to cover the program at the higher 90% match rate.

Post-Partum Women – The post-partum period refers to the time after a woman has given birth. In the context of Medicaid coverage, the current program for low-income pregnant women provides coverage for two-months post-partum. One commonly recurring proposal has been to expand the eligibility of this targeted coverage for pregnant women from 2 months to 12 months post-partum.

Serious Mental Illness (SMI) – a mental, behavioral, or emotional disorder resulting in serious functional impairment, which substantially interferes with or limits one or more major life activities.

INDIVIDUAL MARKETPLACE

Affordable Care Act (ACA) – A federal law passed in 2010 that, among other things, enhanced federal funding for state public coverage (citizens ineligible for Medicaid with incomes up to 138% of FPL) and created highly regulated health insurance marketplaces with premium restriction and income-based federal subsidies (ACA Marketplace) in 2014. Generally, the term “ACA Plans” refer to individual health insurance policies offered on the ACA Marketplace.

ACA Marketplace / Individual Marketplace / Exchange – The Marketplace or Exchange is a website where consumers can compare health insurance plans that comply with the rules of the ACA, and can see if they are eligible for subsidies and cost-sharing reductions. The Federal Government operates the exchange for many states, including Texas currently, at www.healthcare.gov. Texas could choose to operate its own exchange and potentially realize financial savings and certain policy flexibilities (see State-Based Exchange).

Actuarial Value – See “Metal Level”

Net Premiums / Net Consumer Cost – In the context of ACA Plans, the net premium is the amount that a consumer will pay for a health insurance plan on the ACA Marketplace after accounting for ACA subsidies.

Benchmark Plan – A benchmark plan is a specific insurance plan on the ACA Marketplace that is used to calculate the amount of premium subsidies for which individuals are eligible. The current benchmark plan used is the second-lowest-cost Silver Plan.

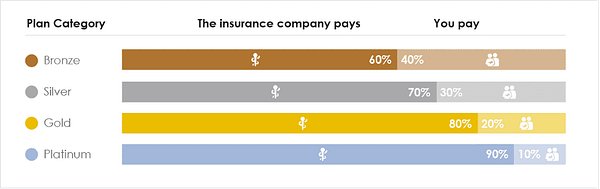

Metal Level – For health insurance plans offered on the ACA Marketplace, a “metal level” system is used to help consumers understand how generous the plans are. The metal levels are assigned based on the plan’s “Actuarial Value” which is an estimate of what percentage of an enrollee’s overall health costs the plan is expected to pay, and is expressed as a percentage. The chart below summarizes the metal levels of ACA Plans.

Cost-Sharing Reductions (CSRs) – On certain ACA Plans, these are discounts that lowers the amount enrollees have to pay for out-of-pocket costs, like deductibles, copayments, and coinsurance. Enrollees who anticipate they will earn less than 250% of the FPL and who purchase a Silver-Level plan are eligible for these extra savings.

“Silver-Loading” – In October of 2017, the Federal Government announced that it would no longer separately pay insurers to cover the cost of cost-sharing reductions required for eligible enrollees under the ACA. While insurers would still be required to offer these savings to enrollees, the Federal Government took the position that it did not have legal authority to directly reimburse the insurers for those payments because Congress had not appropriated any money for that purpose. In response some insurers increased the premiums of their Silver-level plans to account for some of the unreimbursed costs of the CSRs. This workaround is known as “Silver-Loading.” Because Silver-level premiums have increased, and the benchmark plan is a Silver-level plan, net premiums for many individuals purchasing Bronze or Gold plans have decreased.

- One of the policy options we model – Focused Rate Review – acknowledges that silver-level plans have not “Silver-loaded” enough to cover the actuarial costs of those CSRs, and that by doing so, net premiums for many Texans would decrease.

Premium Subsidy / ACA subsidies / APTCs – A premium subsidy is an amount of money that helps individuals pay for the costs of health insurance premiums. In the context of the ACA (ACA Subsidies) they are income-based federal financial assistance to purchase health insurance policies on the ACA Marketplace. Their official name is “Advance Premium Tax Credits (APTCs).” Enrollees who anticipate they will earn less than 400% of FPL in the upcoming year are eligible for these subsidies on a sliding income scale.

- The amount of the subsidy is calculated based on your estimated income and the gross cost of a “benchmark” plan. A percentage of an enrollee’s estimated income is subtracted from the full premium cost of the benchmark plan, and the remaining balance is the amount of the subsidy the individual is eligible for. That subsidy can then be applied to any insurance plan offered on the ACA marketplace. This often results in lower premiums for older enrollees relative to younger enrollees. For a more detailed explanation, see this article.

State-Based Exchange (SBE) – A platform to administer health insurance enrollment. A state exchange is an alternative to the default federal exchange, which is operated at www.healthcare.gov. A minority of states run their own exchanges, but more are doing so each year due to cost-saving opportunities and additional innovation flexibility available with 1332 Waivers.

Focused Rate Review – Texas does not currently conduct review of premium rates filed for ACA Marketplace Plans. Traditionally, review of insurance premium rates has been focused on overall premiums. The ACA premium subsidy dynamics are non-intuitive and complicated – what most consumers pay is not directly related to overall premiums. Unfortunately for consumers and insurers, unchecked premium rate development has led to premium misalignment resulting in approximately $500 million in underfunded premium subsidies in Texas, higher net premiums for subsidy-eligible enrollees, and lower enrollment.

- With legislative authority, and for a moderate administrative cost, the Texas Department of Insurance (TDI) could review (and approve or reject) premium rates with greater focus; enforced compliance would initially result in a larger share of premiums being paid by the federal government. This would attract a larger, healthier population and ultimately reduce average costs and premium rates in the marketplace. Click here to learn more. It is also important to note that whatever expenses TDI would incur in implementing this task would not have an impact on the state’s General Revenue funds because TDI is a self-funded agency whose expenses are recouped through industry assessments.

- The impact of this initiative would increase the amount of federal subsidies flowing to Texas. This would not only reduce net premiums for many Texans, but would also increase the amount of federal funds that would be available for the state should it choose to pursue a future 1332 Waiver. Because of this, should Texas wish to pursue a 1332 Waiver, it should first conduct Focused Rate Review. Relative to other options states have considered, there is minimal additional cost associated with focused rate review efforts. Click here to learn more.

“Family Glitch” – The “Family Glitch” refers to a seemingly unfair result that occurs for some low-income families where one member receives health insurance coverage through their employer. Families who are determined to have access to “affordable” coverage through an employer are ineligible for subsidies on the Marketplace. Whether or not coverage is “affordable” is determined by comparing the expected employee contribution for coverage as a percentage of household income. The “glitch” can occur when the employer’s coverage is “affordable” for the employee, but becomes unaffordable for other household members. Some employers offer coverage to employees at free or heavily discounted rates, and charge much higher rates if the employee wishes to also include other family members on the plan. But because “affordability” for purposes of ACA subsidy eligibility is determined only on the basis of the employee’s contribution to cover him or herself, other family members may find themselves ineligible for ACA subsidies, and unable to afford the coverage offered by the employer.

1332 Waiver – Section 1332 of the ACA permits a state to apply for a State Innovation Waiver (now also referred to as a State Relief and Empowerment Waiver) to pursue innovative strategies for providing their residents with access to high quality, affordable health insurance while retaining the basic protections of the ACA. These waivers allow states to implement innovative ways to provide access to quality health care that is at least as comprehensive and affordable as would be provided absent the waiver, provides coverage to a comparable number of residents of the state as would be provided coverage absent a waiver, and does not increase the federal deficit. Click here to learn more

- Section 1332 Waivers were first available for plan year 2017 and in late 2018, the Centers for Medicare and Medicaid Services (CMS) released new guidance along with four policy concepts that states could implement through a 1332 Waiver. The policy concepts were 1) account-based subsidies, 2) state-specific premium assistance, 3) adjusted plan options, and 4) risk stabilization strategies. Each policy concept is described briefly below:

- Account-based subsidies–States could fund individual consumer-driven accounts for the purposes of paying health insurance premiums and other out-of pocket expenses using federal pass-through funding redirected from premium tax credits and small business health care tax credits. Such funding could be combined with employer and individual contributions.

- State-specific subsidies– States could create a new state-based subsidy program designed to be more responsive to state residents’ needs. Using federal pass-through dollars, states could distribute premium subsidies differently than is done today. For instance, a state could opt to increase subsidies for those at the lower end of the income spectrum while decreasing subsidies for those who earn more. Alternatively, a state could opt to calculate and distribute subsidies based on income and any number of other factors, including age, geographic location, etc.

- Adjusted plan options–States could allow the use of subsidies for non-ACA plan options. For example, states could allow qualified individuals to use subsidies to purchase short-term limited-duration insurance (STLDI) plans, condition management plans (plans customized for those with specific health conditions, including diabetes, heart conditions, etc.), or copper-level plans.

- Risk-stabilization strategies–States could develop risk-adjustment strategies, including reinsurance programs, high risk pools, etc. to help mitigate the effects of high-cost claims on the entire market, thereby lowering premium costs for insurance consumers in the state and decreasing the overall cost for federal tax subsidies in the state. The federal government then returns the realized savings back to the state in the form of pass-through funding.

- State waiver plans may use any one of these concepts or a combination of two or more. It should also be noted that three of the four waiver concepts (the exception being risk-stabilization strategies) require a state-based exchange due to policy and operational limitations imposed on the federally-facilitated exchange. Click here to learn more.

Federal Guardrails – States that apply for a 1332 Waiver must demonstrate that their proposal meets the four federal “Guardrails.” The four guardrails are:

- Coverage must be at least as comprehensive

- Coverage must be at least as affordable

- Coverage must be at least as extensive (i.e., a comparable number of people must be covered under the waiver as without it)

- Federal budget neutrality – The cost to the federal government cannot be more than it would have been absent the waiver.

Pass-Through Funding – If a state’s 1332 waiver is projected to reduce federal costs, then the state may be able to receive “pass-through” payments from the federal government up to the amount of the federal savings. Pass-through funding is limited to the amount of premium tax credits, cost-sharing reductions, and small-business tax credits that the federal government would have provided to the state’s residents absent the section 1332 waiver, minus the amounts for those items that the federal government actually will provide. The federal government recalculates each state’s pass-through funding annually, using the most up-to-date information available on enrollment, premiums, enrollee characteristics, and other factors. That means the amount of pass-through funding a state ultimately receives may be different from the amount it anticipated in its waiver application.

Reinsurance Pool – A reinsurance pool aims to reduce the price of premiums (but not necessarily net premiums) by “pulling out” certain high costs from general community risk pool. By pulling these costs out, the theory is that unsubsidized premiums will be lowered, and that those costs pulled out could be partially paid for by pass-through funding from the resultingly lower federal subsidies. The resulting premium dynamics of both options are two-fold: unsubsidized enrollees receive some relief from high premiums. There is usually a small premium increase for most subsidized enrollees as subsidies are reduced and the overall enrollment impact is generally modest.

- Claims-based model – Under a claims-based model, once an individual’s annual claims amount exceeds an arbitrarily set threshold, those costs are transferred to the reinsurance pool.

- Condition-based model – Under a condition-based model, all claims from individuals who are determined to have high-risk conditions are transferred to the reinsurance pool.

Subsidy Optimization – This is a 1332 Waiver concept that would allows states to replace the inherent structural inefficiencies in the ACA with broader subsidies across the income spectrum. Subsidy Optimization removes the family glitch, subsidy cliffs and other problems that have plagued ACA enrollment.

- The risk associated with Subsidy Optimization is that federal support is limited to pre-waiver funding. If enrollment exceeds expectations and incremental enrollees are eligible for subsidies, the state could be responsible for funding after federal funds are exhausted. It may be possible for the state to cap enrollment eligibility to cap its expenses, but this would need to be negotiated with CMS. Policy options allow for reducing the tax credit amounts to protect the state budget while still providing an attractive market. Funding can be recalibrated in future years to strike an appropriate balance.

- Structurally, optimized subsidies are scaled by age and income. Age scaling allows for new incentives for younger enrollees while still recognizing that expected health care costs rise with age and providing higher tax credits for older people. Income scaling is designed to maintain stability by avoiding significant adverse changes from the ACA and not cannibalizing the small employer market with extremely attractive incentives for employers to drop existing employer-sponsored coverage.

- The base ACA subsidies are scaled by income, limited to enrollees under 400% of the FPL, and formulaically advantageous to older individuals, resulting in a skewed market unattractive to healthy, young people. By scaling the credits by age and eliminating the 400% requirement, Subsidy Optimization could help dramatically reduce costs for those currently priced out of the market. This primarily benefits younger low-income enrollees and those over 400% of the FPL; this will attract a younger, healthier mix of enrollees that will contribute to long term stability and reduction in costs in the individual market.

- The formula used to calculate subsidies in this concept is: Subsidy = (Base Subsidy x CMS Age Factor) / (FPL % x if(FPL > 200% then 1.286 else 1.000))

- The Base Subsidy is the current subsidy that would be applied to a 21 year old making 100% of the FPL.

- The major policy objectives of this concept are two-fold:

- First, there is an immediate objective to encourage more individuals to enroll using the same amount of subsidies that the Federal government is currently spending.

- Second, there is a longer-term objective of creative a virtuous cycle and healthy marketplace – if younger and healthier individuals sign up in greater numbers, average gross premiums will decrease, encouraging more younger and healthier people to sign up etc…. And because subsidies would be based only on age and income (and not tied to a benchmark plan), reductions in gross premiums will lead to a reduction in net premiums as well, creating real incentives for health insurers to keep premiums low.