Proposed Formula Description

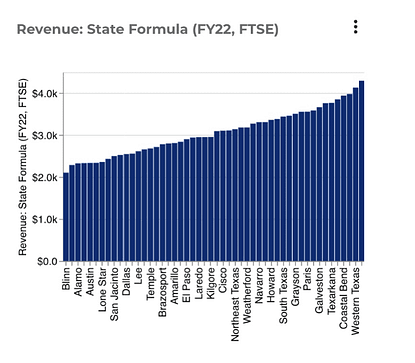

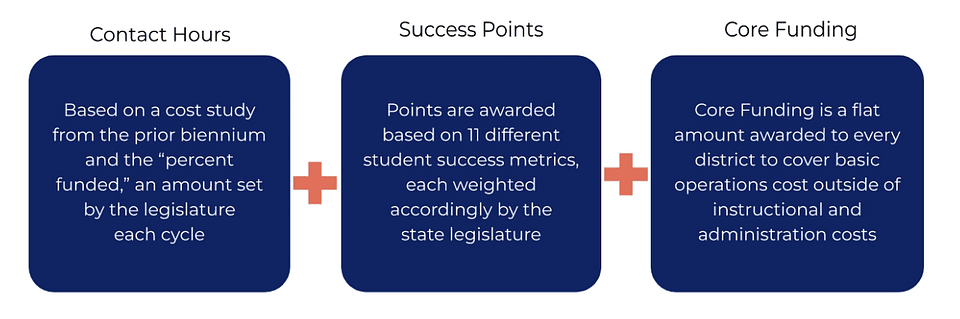

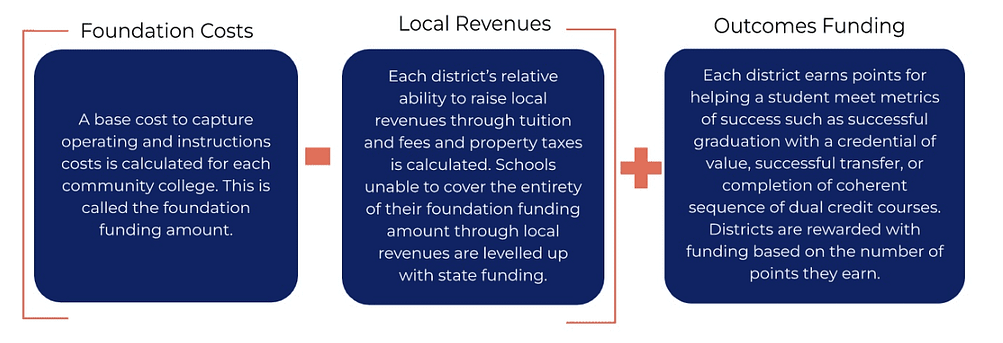

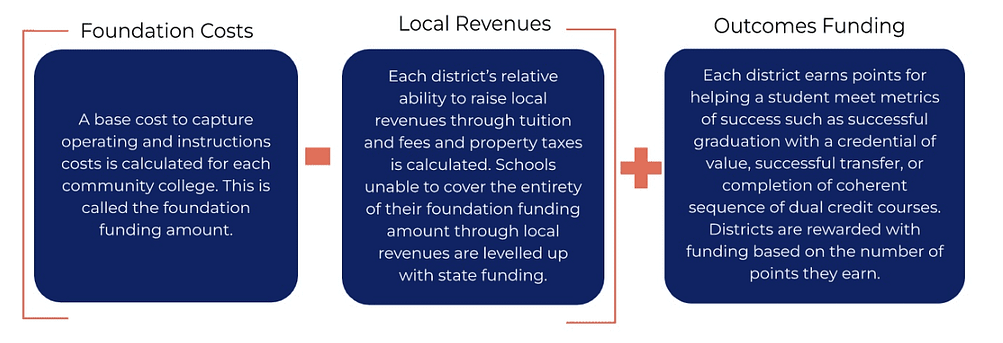

The Proposed Formula model is fundamentally different from the Current Formula model. The Current Formula model allocates funding based on state priorities and available funds without adjustments for a district’s own revenue-raising capacity. The Proposed Formula model first estimates districts’ operating need, provides users with the option to subtract from that need based on a district’s taxing capacity and tuition and fee estimates to determine state aid for operating costs, and then adds outcomes-based funding.

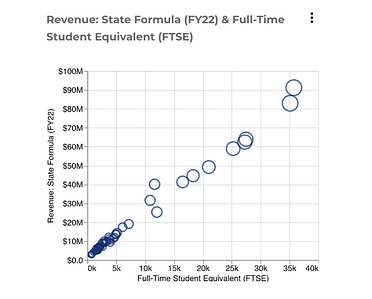

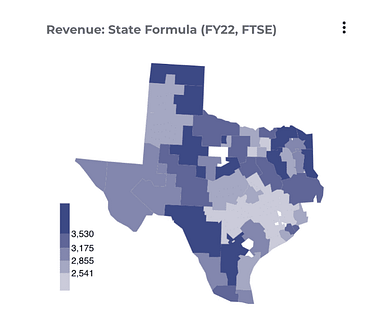

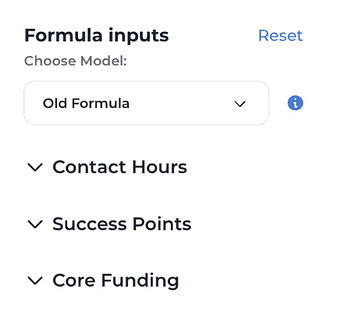

The Guaranteed Yield first estimates the total funding necessary, regardless of revenue source, to meet a district’s instructional and operating costs. This is their Foundation Funding amount. The calculation begins with the annual cost study administered by the Texas Higher Education Coordinating Board (THECB) and adapted for the Contact Hours formula. Users have the option to determine what percentage of the total instructional and operating costs should be factored into the state’s formulas. Next, a per-student dollar amount is set for the Basic Allotment that will be multiplied by each Full-Time Student Equivalent (FTSE) served by a college district. Demographic weights are then applied to a district’s FTSE count to estimate the additional costs associated with educating students with additional needs. These students are identified as academically or economically disadvantaged or as adult learners. Academic Disadvantage is defined as the percentage of students identified as not being college ready in reading, writing, or math, based on students’ scores measured by the Texas Success Initiative Assessment. Economic Disadvantage is defined as the percentage of students receiving a federal Pell Grant. Adult learners are students who are at least 25 years old. There is also a Small Schools weight to account for diseconomies of scale among college districts who serve fewer students relative to other districts. Once the percentage is set for Contact Hours, and all demographic and institutional weights are applied to college districts’ FTSE counts, the totals are added together. The sum is a full estimate of district operating needs. This will be the base used to identify the state’s portion of funding for operations costs.

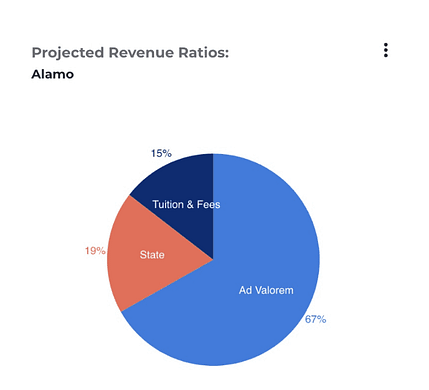

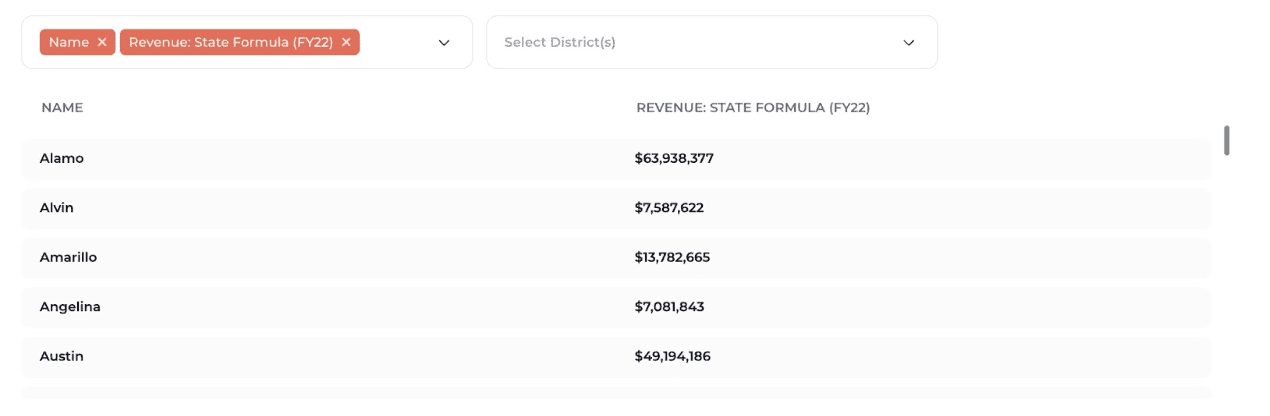

Revenues from Ad Valorem (Property) Taxes and Tuition and Fees are components of a district’s potential estimated Deductions. This is the amount of money that a district is estimated to be able to provide for its own operations costs. The Deductions are subtracted from the base Foundation Funding amount because it includes operating costs that are being paid for by other revenue sources, including Property Tax and Tuition revenues, in addition to state funding.

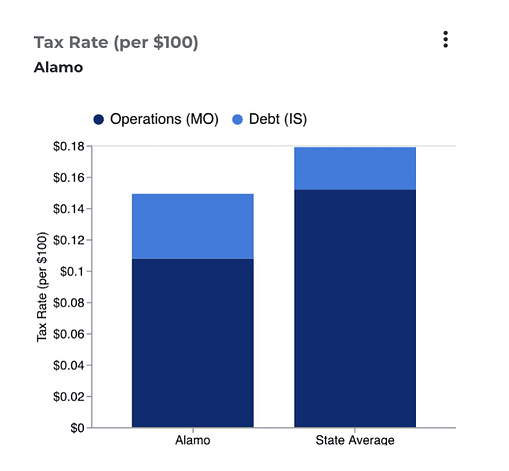

Districts are restricted from raising more than $1 per $100 in taxable property within a given district (Texas Education Code, Sec. 130.122), and no district is raising more than $0.40 based on the most recently available data. For the Ad Valorem Deduction, the user can set a contribution percentage, which is a proportion of the total tax rate allowed by state law. The tool is meant to simulate changes only to state policies, not local policies. As such, users will be limited from raising the contribution percentage higher than $0.05 to limit simulations only to those that would not force local decisions on property tax rates. To adjust the Tuition and Fee Deduction, users set a dollar amount that is multiplied by the number of FTSEs served in a district. The Ad Valorem and Tuition and Fee Deductions are then added together to determine a district’s total Deductions amount.

A district’s Guaranteed Yield appropriation is calculated by subtracting their total Deductions amount from their Foundation funding levels. The difference equals the district’s Guaranteed Yield appropriation. However, it is important to note that it is possible for a district to have a Deductions amount greater than their Foundation Funding amount, depending on how a user chooses to simulate the Deductions. This aligns with the Commission’s recommendation that the Guaranteed Yield only be provided to districts with low taxable valuations to address diseconomies of scale between districts.

Outcomes Funding is added on top of a district’s Guaranteed Yield. The outcomes metrics align with the Commission’s final recommendations: credential of value graduates, credentials of value awarded in a high-demand field, successful transfer up to a four-year university, and completion of a sequence of dual credit courses applicable to collegiate-level academic and workforce program requirements. For each student who produces these outcomes, districts earn points based on the weights applied to each metric. Districts can also earn additional points if the student earning the point(s) is Economically or Academically Disadvantaged or is an Adult Learner. A district’s Outcomes Funding amount is determined by multiplying the total points the district earns by a dollar amount set by the state.

The Commission also recognized the potential need to help districts smoothly transition to the new finance system to ensure funding stability for themselves and their students. Cap and Floor functions are meant to simulate options to this effect. The Hold Harmless option allows users to set a guaranteed minimum level of funding for districts based on a percentage of their state funding levels in Fiscal Year 2022. Similarly, the Gains Cap option allows users to set a maximum level of funding that districts can receive under the new formula based on a percentage of their state funding levels in Fiscal Year 2022.