In the wake of Russia’s invasion of Ukraine and international efforts to stop Russian oil and gas exports, Texas’ oil and gas production capabilities are in the national and international spotlight. The position Texas finds itself in now is radically different from two years ago.

In spring 2020, Texas’ energy sector was in chaos. The onset of the COVID-19 pandemic crushed the nation’s demand for oil. State production and drilling slowed dramatically as oil price futures dipped into negative territory. The Railroad Commission even held a hearing on oil and gas proration in order to limit production and stabilize falling prices. While the Commission ultimately elected to not pursue proration (for the better), the state’s oil and gas industry began a long, slow recovery from the catastrophic damage wrought that spring.

Two years later, the tide and the tables have changed entirely. Now, state oil and gas production are on track to beat records not seen since the beginning of the pandemic. According to recent US Energy Information Administration (USEIA) data, Texas produced 154,638 million barrels of oil in December 2021. This is close to the five million barrels per day record benchmark set in late 2019 and early 2020. If oil prices hold at current levels, these production levels will continue to rise.

Texas’ natural gas production is also surging. USEIA data indicates that the state generated 940,352 million cubic feet of gas in December 2021. This was a record: never before had Texas generated this much gas in a single month. That gas was essential not only for home heating and electric power during the winter, but also for the manufacture of liquefied natural gas (LNG) essential for European markets looking for alternatives to Russian energy.

While Texas’ oil and gas production has increased, so, too, have prices. As of this writing, West Texas Intermediate (WTI) prices exceed $110 per barrel, approaching levels not seen since the eve of the Great Recession in 2008. More importantly, recent volatility in oil prices is historically unprecedented: between April 2020 and now, WTI futures jumped from -$37.63 to $122.50. Natural gas prices are also significant at $4.83 per million BTU, over double the price from one year ago.

Unfortunately, these higher energy prices translate into consumer pain as Texans pay more at the gas pump and for home heating and electric bills.

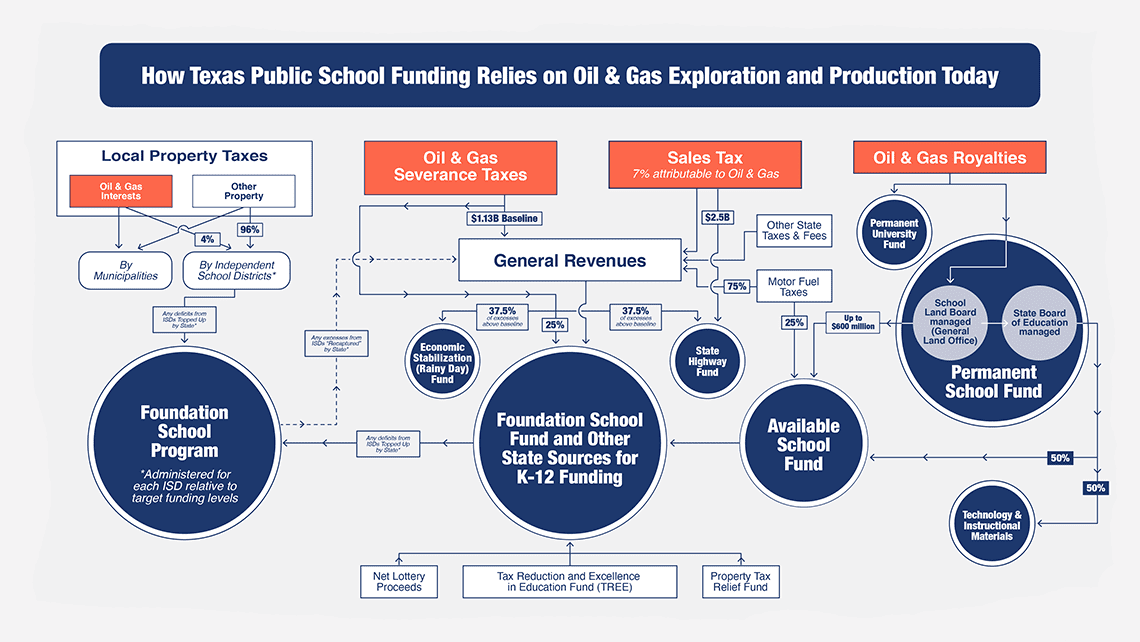

The State of Texas stands to benefit from these higher oil and gas prices and production, however. As indicated in the chart from Texas 2036’s report on state oil and gas revenues, severance taxes, sales taxes, and royalties make significant contributions to key state programs. For example, severance taxes contribute to the state’s Rainy Day Fund and help pay for education and transportation needs. Oil and gas royalties from state lands make substantive contributions to the state’s public and higher education endowments.

While the state may be experiencing a short-term windfall from high oil and gas prices and production, the underlying issue of revenue stability remains. As Texas 2036 points out in our 2021 report, state revenues from oil and gas are as variable as energy prices are volatile.

Just as Texas has faced oil and gas booms, as we do now, we have endured busts, as we did in 2020. Consequently, state leaders face a growing problem of paying for essential programs – including public and higher education – as oil and gas revenues fluctuate over time.

A key answer to this problem rests within Texas’ energy expansion. While oil and gas will continue to play an important role in our state’s and nation’s strategic future, our energy portfolio is expanding to include newer, cleaner sources of energy such as hydrogen, geothermal, and renewables. Growing these emerging energy sources represents an opportunity for both economic growth and stable state revenues associated with that expansion.