Texas 2036 Guide to the State Budget

This is a preview of our Texas 2036 newsletter with what you need to know about the state budget. To receive this weekly look at our work, sign up here.

Unpacking the 2026-27 State Budget

From public safety and education to infrastructure and health care, the state budget shapes the services Texans rely on every day.

With $338 billion on the table for 2026-27, here’s what’s in the budget, what happens next and the smart investments we’re excited to see for Texas’ future.

Today’s investments impact Texas tomorrow

With more than 1,500 new residents arriving daily, lawmakers are planning for the future while prioritizing responsible spending.

According to the state comptroller, Texas’ economy is expected to keep growing.

- Gross State Product is projected to grow 4.7% annually in FY 2026–27

- Personal income is forecast to rise 6.2% and 5.7% in those years

- Unemployment is expected to remain steady, ticking up slightly from 4.1% to 4.3% by FY 2027

Why this matters? By making fiscally responsible, long-term investments today, lawmakers can ensure a brighter future for a growing state.

The budget is a “must pass” bill

The Texas Constitution requires lawmakers to pass a balanced budget each session because without it, state agencies can’t operate. It’s the only bill that must pass.

Did you know? The House and Senate take turns starting the budget. This session, it’s the Senate’s turn, so the 89th Legislature’s budget is Senate Bill 1.

What’s next for the state budget?

The latest: On Wednesday, lawmakers released the final version of SB 1, which is the state budget that will guide Texas’ investments over the next two years.

What’s next? By rule, the House and Senate must wait 48 hours before a final vote, putting Friday afternoon as the earliest option.

🤝 After both chambers vote, the Comptroller checks that projected revenue covers the plan.

📝 Then it heads to the Governor, who has until June 22 to sign off or make line-item vetoes.

✅ If approved, the budget takes effect September 1, 2025, guiding Texas’ investments through August 2027—a key step toward building a strong future for the state.

Where does the money go?

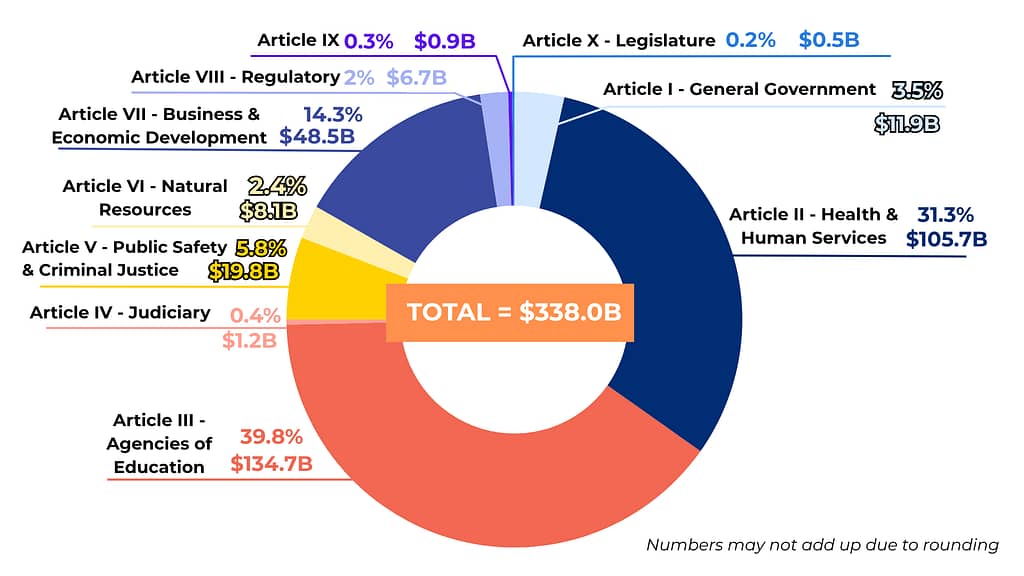

The state budget (SB 1) that lawmakers will consider in these last few days before the session concludes would spend about $338 billion from all revenue sources.

What to know: Traditionally, SB 1 directs the largest share of funding to education from PK-12 to higher ed and Health & Human Services like Medicaid, Children’s Health Insurance Program (CHIP) and Supplemental Nutritional Assistance Program (SNAP).

It also supports key areas like public safety, economic development, the judiciary, regulatory agencies and programs under the Governor’s Office.

The chart below breaks down SB 1 by budget article:

Source: Legislative Budget Board (Summary of Conference Committee Report for Senate Bill 1, Appropriations for the 2026-27 Biennium (May 2025))

Source: Legislative Budget Board (Summary of Conference Committee Report for Senate Bill 1, Appropriations for the 2026-27 Biennium (May 2025))

📘 Closing the Books on the Current Budget

In addition to funding priorities for the next two years, lawmakers also have another final task before June 2: putting the finishing touches on the current biennial budget, which controls spending through this August.

That’s where 🧾 House Bill 500, this session’s supplemental appropriations bill, comes in. The supplemental appropriations bill helps address shortfalls, adjust allocations and, in some cases, jump-start new priorities.

Inside the budget: What we’re excited about

As we dig through more than 1,100 pages of the state’s budget (SB 1 and HB 500), we’re thrilled to see strong support for several Texas 2036-backed priorities that have been included for final approval. Here’s a breakdown:

💧Water Infrastructure: $1.7 billion in new funds plus the potential for $1 billion annually if voters approve House Joint Resolution 7.

🔥Wildfire Response: Over $600 million to better prepare and respond to wildfires.

⛽️ Abandoned Wells: $100 million to plug orphaned oil and gas wells.

⚡️Energy Expansion: $350 million for the Texas Advanced Nuclear Development Fund.

⭐️ Space Research: $300 million more for the Space Exploration & Aeronautics Research Fund.

💵 Pension Reform: $1 billion toward Employee Retirement Services payments required by SB 321 (2021), saving the state on future interest costs.

🩺 Health Care Transparency: $9 million to fully fund the Texas All-Payor Claims Database.

🧑🏫 Higher Education:

- Up to $1.3 billion more for the Texas University Fund (TUF).

- Full funding for community college finance reforms from House Bill 8.

- Support to create a dedicated capital fund for Texas State Technical College system, pending voter approval of SJR 59.

💻 IT & Cybersecurity Modernization:

- $135 million to launch the proposed Texas Cyber Command.

- $59.5 million to replace the outdated DFPS IMPACT system.

- Over $5 million to upgrade state workforce data systems.

📚Public Education:

The budget includes $8.5 billion in new investments to support students, teachers and schools across Texas. Highlights include:

- Pay raises for teachers and support staff

- Increased basic allotment tied to property value growth

- Updated public education goals

- Stronger support for early learning

- Expanded career and technical education

- Improved literacy and math instruction for young learners

The Bottom Line: These investments reflect smart, forward-thinking choices that help secure Texas’ long-term prosperity.

What did Texas 2036 do to help this session

Texas 2036 testified more than two dozen times in legislative appropriations hearings, offering guidance to ensure both one-time and ongoing investments support fiscal sustainability and better government performance.

The final budget shows a clear commitment to smart, sustainable spending for Texas’ future.

“It is a challenge to land the plane in any budget cycle – but the investments in SB 1 and HB 500 aim to meet our state’s current and impending infrastructure and economic challenges while preserving fiscal flexibility for future legislatures.”

“It is a challenge to land the plane in any budget cycle – but the investments in SB 1 and HB 500 aim to meet our state’s current and impending infrastructure and economic challenges while preserving fiscal flexibility for future legislatures.”

– Rahul Sreenivasan, Director of Government Performance & Fiscal Policy