Are institutions to blame for high housing prices?

Blackstone’s recent $10 billion acquisition of real estate investment trust AIR Communities and a Wall Street Journal article noting that investors bought more than one in four single family homes sold in 2022 have revived questions about the role of institutional buyers in the housing market. In Texas, committees in both the House and Senate have been tasked with studying the issue, while lawmakers in Ohio, Nebraska, Georgia, and Minnesota have already pursued legislation to curb the presence of housing investors.

While institutional buyers are important players in housing markets, claims of their outsized influence on housing markets often conflate multiple types of buyers and issues. Clarifying the role of these buyers is a crucial step toward understanding the scope of the housing affordability crisis, so lawmakers can take more effective measures to address it.

Question One: What is an institutional buyer?

The first issue when discussing institutional buyers is the definition of “institutional” itself. The term is often used interchangeably with “private equity,” “Wall Street,” “corporate landlord” and “investor” and typically conjures the image of a distant monolith like Blackstone. But even among those who study the issue, definitions are not consistent:

- The National Association of Realtors defines “institutional buyers” as “companies, corporations, or limited liability companies (LLCs),” which captures everyone from firms with thousands of homes in their portfolios to individuals who own a single rental property.

- Real estate research group Parcl Lab defines institutional owner as a firm owning more than 1,000 homes.

- The Urban Institute considers institutional owners as those owning at least 100 homes.

- Analytics firm CoreLogic defines investor owners as those who own at least three homes at one time.

It’s also inconsistent whether iBuyers (digital companies like Zillow and OpenDoor that usually make cash offers on homes and resell to families or institutions), are considered institutional buyers themselves. And those short-term holders of homes like the iBuyers, nonprofits, governments and house flippers should be considered differently than long-term holders who purchase properties to rent out.

With that level of nuance, it is difficult to succinctly summarize and analyze the impacts such buyers have on local housing markets.

Question Two: How many homes do institutions actually own?

With so many categories of entities that can fall under the umbrella definition of “institutional buyer,” it quickly becomes clear that the distant monoliths of home purchases are not that monolithic.

Blackstone, the third-largest owner of single family homes in the country, owns 0.07% of the approximately 89 million owner or renter occupied single family homes in the United States. The top three owners of single family homes own a combined 0.25% of occupied single family homes.

Parcl Labs found that institutional owners — which, as a reminder, Parcl defined as firms that own at least 1,000 homes — own approximately 0.67% of the U.S. single family housing stock, or about 600,000 homes.

This is a larger share of the U.S. housing market ownership than what the Urban Institute attributes to what they call “mega investors.”

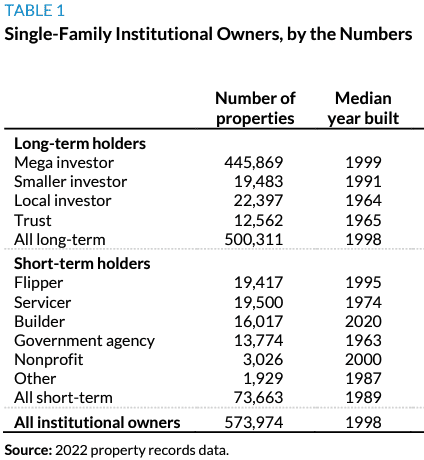

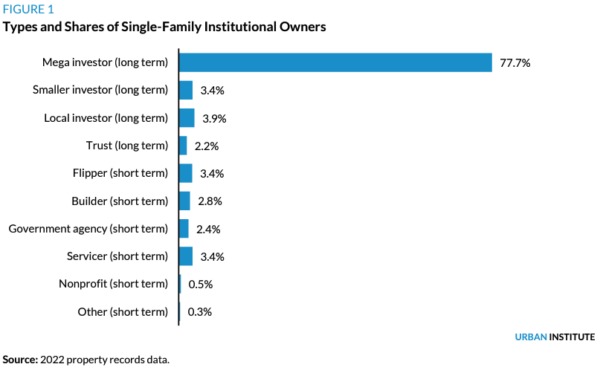

In its research, the Urban Institute found 32 mega firms who are long-term holders, with ownership of about 446,000 homes. Combined with smaller investors and short-term holders, they found that investors own about 573,974 single family homes, which is 0.6% of the single family housing stock*. Data from the Urban Institute is outlined further in the charts below:

Question Three: Did investors buy 44% of the single family homes in 2023?

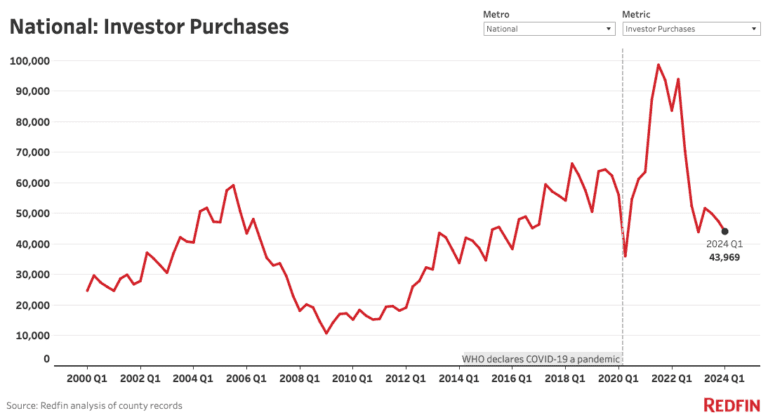

In short, no. Since the 2008 financial crisis, institutional buyers have been robust participants in the housing market. But it is likely that much of the recent concern about institutional buyer home purchases stems from the COVID-era purchasing frenzy in which investors were driven to the market just as other buyers were.

That activity appears to have stabilized following the shock of rising interest rates. Redfin’s recent data release shows that investors purchased about 44,000 homes in Q1 of 2024, down from nearly 100,000 in late 2021 (Redfin data dating back to 2000 is displayed in the chart below).

It is important to note that Redfin has a very broad definition of “investor”:

[A]ny buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.

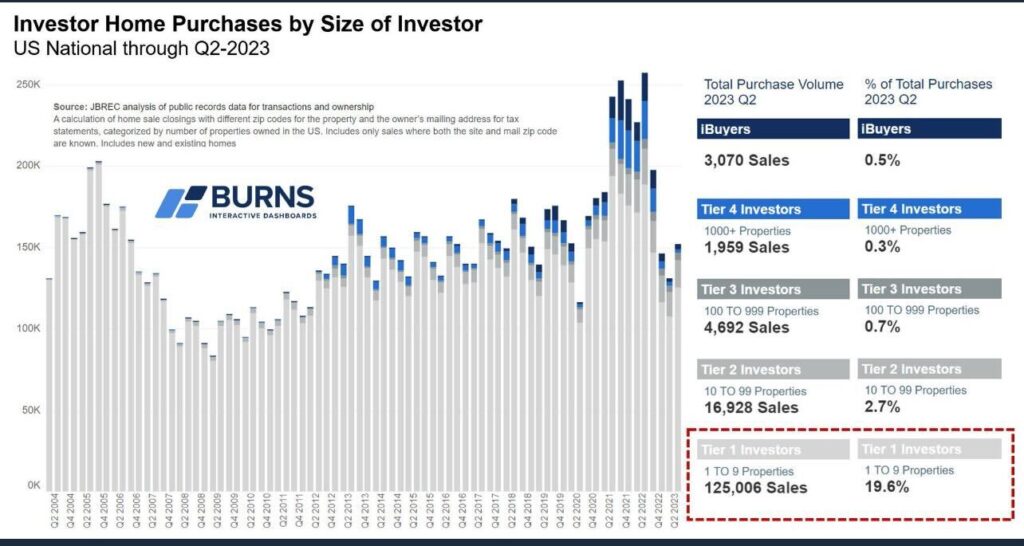

As such, it is likely that Redfin’s analysis aligns with the chart below from HousingWire, which shows that the overwhelming majority of “institutional buyers” are those who are purchasing 1-9 properties.

The Texas Connection

According to real estate firm Amherst, of the 471,000 single family homes transacted in Texas in 2023, 83% were bought by owner occupants or individuals. Large firms with at least 5,000 homes in their portfolios** purchased only 0.7% of single family homes.

Question Four: Are institutions removing homes from the market?

Again, the answer appears to be no. Usually, institutions seek to purchase lower-priced homes in need of repair. They fix the homes up and, as the data from the Urban Institute has shown us, rent them out.

One concern regarding the presence of institutional buyers is that they remove homes from the market. When one considers the overall housing market, including rentals, this does not appear to be the case. There is a market for families who, for a variety of reasons, wish to rent single family homes, and these buyers respond to that market. This strategy is a net neutral for overall housing supply.

Similarly, some critics of institution-owned housing are wary of developers who are building neighborhoods of single family homes for rent. In this case, such institutions are adding to the housing stock and helping to alleviate the nationwide undersupply of homes. By creating more overall supply, these actions may be serving to mitigate affordability concerns rather than exacerbating them. As such, “built to rent” communities should not be included in any calculus critiquing the presence of institutional buyers.

The upcoming Senate State Affairs committee hearing will include an evaluation of “large-scale purchases of single-family homes by domestic entities”, a step towards taking a measured approach to allaying concerns and dispelling disinformation about these players in the market. Solving housing unaffordability begins with a good understanding of the data behind the crisis.